Master Your Money with the 50/30/20 Rule

Budgeting doesn't have to mean tracking every single latte or feeling guilty about ordering takeout. The 50/30/20 budget rule is a refreshingly simple framework that has helped millions of people take control of their finances without the stress of complicated spreadsheets.

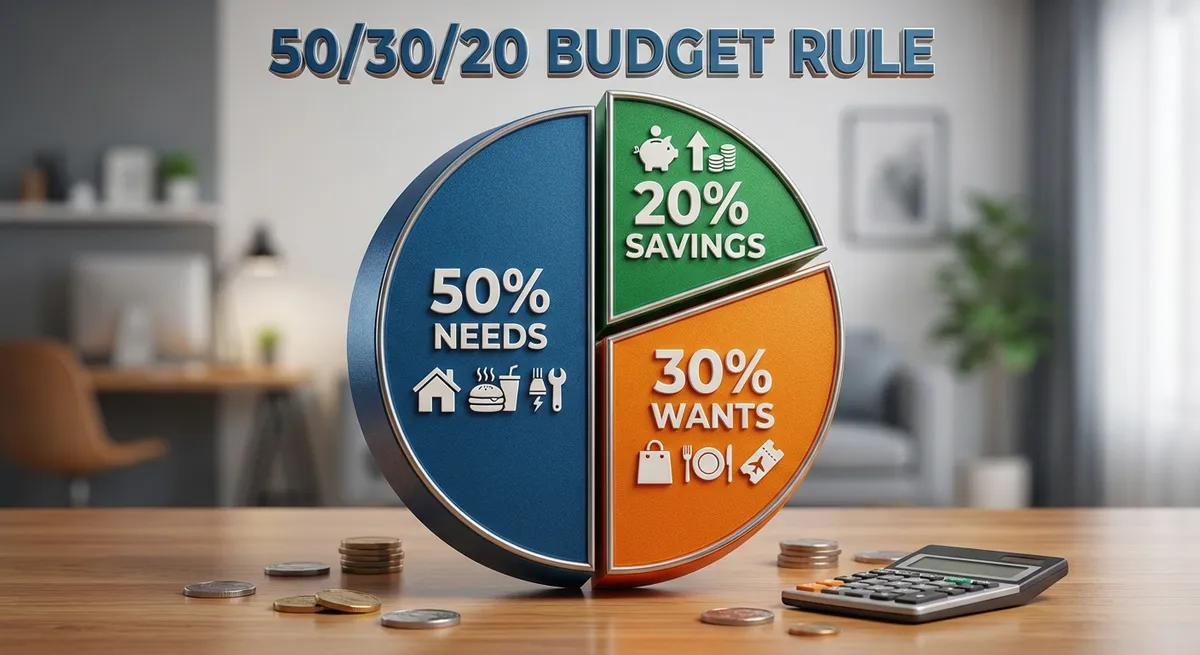

Popularized by Senator Elizabeth Warren, this method cuts through the noise by dividing your after-tax income into just three clear buckets: Needs, Wants, and Savings. It's not about restriction; it's about balance. By giving every dollar a job, you can cover your bills, enjoy your life today, and still build wealth for tomorrow.

Why it works: Most budgets fail because they are too rigid or tedious to maintain. The 50/30/20 rule is flexible. It adapts to your income, giving you permission to spend on what you love as long as you hit your savings targets first.

The Three Buckets: Needs, Wants, and Savings

1. Needs (50%) - The Essentials

These are the bills you absolutely must pay to survive and work. If you lost your job tomorrow, these expenses would remain.

- Housing: Rent or mortgage.

- Utilities: Electricity, water, heat.

- Transportation: Car payment, insurance, gas, public transit.

- Food: Basic groceries (not dining out).

- Minimum Debt Payments: The minimum due on credit cards or loans.

2. Wants (30%) - The Fun Stuff

This is where life happens. Wants are discretionary expenses that make life enjoyable. If you had to, you could cut these out.

- Dining out and easy takeout meals.

- Entertainment, concerts, and movies.

- Vacations and weekend trips.

- Gym memberships and subscriptions (Netflix, Spotify).

- Upgraded clothes or tech gadgets.

3. Savings (20%) - Your Financial Future

This is the most critical bucket for long-term stability. This money pays your future self.

- Emergency Fund: Building 3-6 months of expenses to benefit from compound interest.

- Retirement: Contributions to 401(k), IRA, or Roth IRA.

- Debt Paydown: Any payments above the minimums to kill debt faster.

- Investments: Stocks, bonds, real estate.

Real-Life Examples: How It Looks

Percentages can be abstract. Let's see how the 50/30/20 rule breaks down for different monthly take-home incomes.

Example 1: Entry Level ($3,000/mo)

*Challenge: Rent must be low (roommates) to fit within $1,500 for all needs.

Example 2: Established ($6,000/mo)

*Opportunity: With $1,200/mo savings, you can max out an IRA easily.

Common Questions & Edge Cases

Does my 401(k) contribution count towards the 20%?

Yes, absolutely. Your employer-sponsored 401(k) contributions (and your employer's match!) count as savings. Since these are often deducted before your paycheck hits your account, you might need to add them back into your "income" number to calculate the percentages accurately, or just aim to save 20% of your take-home pay in addition to what's already being saved for retirement.

Where do student loans fit: Needs or Savings?

This is a common point of confusion. The minimum monthly payment is a "Need"—you are legally required to pay it, just like rent. However, any extra payments you make to pay off the loan faster fall under "Savings/Debt Repayment." This distinction helps you see how much of your budget is fixed versus how much is accelerating your financial freedom.

My rent is too high. Can I still use this rule?

If you live in a high-cost area (like NYC, SF, or London), your housing might easily eat up 40-50% of your income alone. In this case, the 50/30/20 rule needs a tweak. Try the 60/20/20 split—keeping savings at 20% is non-negotiable, so you reduce your "Wants" to 20% to accommodate the higher "Needs." Don't stop saving just because rent is high!

How do I handle irregular income (freelance/commission)?

If your income fluctuates, base your budget on your lowest average monthly income. Live off that baseline. When you have a high-income month, split the extra money 50/50: put 50% straight into savings/investments and use the other 50% for wants or future needs. This prevents lifestyle creep during good months and protects you during lean ones.

What if I can't save 20% right now?

Don't let perfection be the enemy of progress. If 20% seems impossible, start with 5% or 10%. The habit of saving is more important than the amount initially. Gradually increase your savings rate by 1% every few months or whenever you get a raise. The goal is to work towards 20%, not to give up because you aren't there yet.

Why We Fail: The Psychology of Budgeting

Math is easy; behavior is hard. The 50/30/20 rule works because it minimizes "Decision Fatigue." Instead of agonizing over every $5 purchase, you only have to look at one number: "Do I have room in my 30% bucket?"

Parkinson's Law of Money

"Expenses rise to meet income." If you don't deliberately set aside that 20% first, you will inevitably spend it. This serves as a forced mechanism to break that law.

The "Latte Factor" Myth

Financial gurus love to say cutting coffee will make you rich. It won't. The 50/30/20 rule says: Buy the latte. As long as it fits in your 30%, guilt-free spending actually helps you sustain the budget long-term.

Tools to Help You Stick to It

In 2025, you don't need a pen and paper. Automation is your best friend when trying to adhere to the 50/30/20 rule.

- Budgeting Apps: Apps like YNAB (You Need A Budget), Monarch Money, or Goodbudget can automatically categorize your transactions into Needs, Wants, and Savings.

- Auto-Transfers: Most banks allow you to split your direct deposit. Ask HR to send 20% of your paycheck directly to a High-Yield Savings Account (HYSA) at a different bank, so you never even see it in your checking account.

- Cash Envelopes: For the "Wants" category, some people find success withdrawing cash. Once the cash is gone, the spending stops. This is a visceral way to learn discipline.

Frequently Asked Questions

Can couples use the 50/30/20 rule?

Yes, but you have to decide on the approach. You can either combine all income and budget as one unit (the "Joint Pot" method), or each person can run their own 50/30/20 budget based on their individual income. For shared expenses like rent, split them proportionally to income to keep it fair.

Expert Tips from Jurica Šinko

1. Automate the 20%: The secret to success is paying yourself first. Set up an automatic transfer on payday that moves 20% of your check into a separate savings account. You won't miss what you don't see.

2. Audit Your Subscriptions: "Wants" can silently kill a budget. Review your bank statement for recurring charges. That $15 streaming service you never watch is stealing from your vacation fund.

3. The "24-Hour Rule": For any non-essential purchase over $50, wait 24 hours. Impulse buying is the enemy of the 50/30/20 rule. Often, the urge to buy fades by the next day.

The Bottom Line

The 50/30/20 rule isn't a strict law; it's a guide to help you find balance. If you can't hit the numbers perfectly right away, that's okay. Start where you are. Maybe you're at 70/20/10 right now. The goal is to gradually shift your spending until your money is working for you, not against you.

Use the calculator above to visualize your current situation, make a plan, and take the first step toward financial clarity today.