Complete Guide: Understanding Adjusted Gross Income (AGI)

Your Adjusted Gross Income (AGI) is the foundation of your tax return and one of the most important numbers in your financial life. Yet, countless taxpayers don't fully understand what AGI is or how it impacts their finances beyond tax filing.

Whether you're filing your taxes, applying for a mortgage, determining ACA health insurance subsidies, or qualifying for tax credits, your AGI plays a crucial role. This comprehensive guide will demystify AGI, explain how to calculate it accurately, and show you strategies to optimize it for maximum financial benefit.

What Is Adjusted Gross Income (AGI) and Why Does It Matter?

Adjusted Gross Income is your total gross income minus specific "above-the-line" deductions allowed by the IRS. Think of it as your income after certain adjustments but before taking the standard or itemized deduction. Your AGI appears on Line 11 of Form 1040 and serves as the starting point for calculating your taxable income.

Key Insight:

Unlike taxable income (which subtracts the standard/itemized deduction), your AGI is used to determine eligibility for numerous tax benefits, credits, and financial programs. A lower AGI can qualify you for more benefits, even if your total income remains the same.

Why AGI Matters Beyond Taxes:

- ACA Health Insurance Subsidies: Your Modified AGI (MAGI) determines Premium Tax Credits that can save thousands annually

- IRA Contribution Limits: AGI affects whether you can deduct traditional IRA contributions

- Student Loan Interest Deduction: Phases out at higher AGI levels (calculate savings)

- Medical Expense Deductions: Only deductible above 7.5% of AGI

- Mortgage Approvals: Lenders use AGI to calculate debt-to-income ratios

- College Financial Aid: FAFSA uses AGI to determine Expected Family Contribution

- Rental Property Losses: Passive loss rules are tied to AGI thresholds

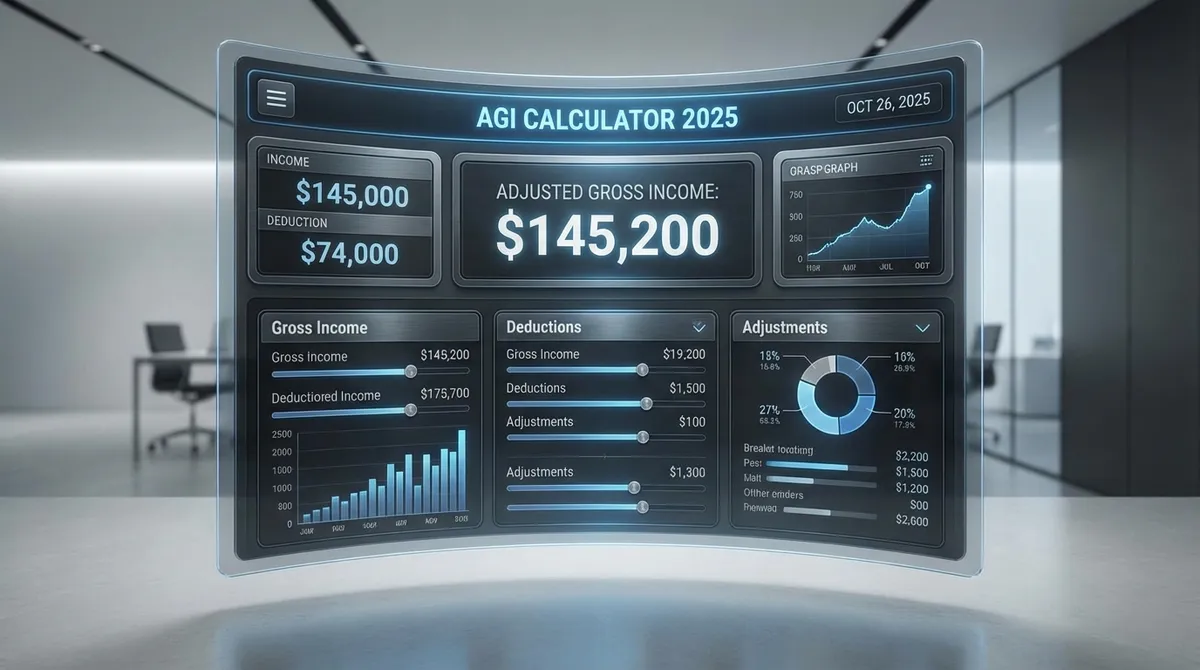

How to Calculate Adjusted Gross Income: The Formula

The AGI calculation follows a simple formula:

AGI = Total Gross Income - Above-the-Line Deductions

Step 1: Calculate Total Gross Income

Start by adding all sources of taxable income, including:

- Wages, salaries, tips (W-2 income)

- Business income (Schedule C)

- Interest income (1099-INT)

- Dividends (1099-DIV)

- Capital gains (Schedule D)

- Rental income (Schedule E)

- Retirement distributions (1099-R)

- Unemployment compensation (1099-G)

- Farm income (Schedule F)

- Alimony received (pre-2019 agreements)

- Other taxable income

Step 2: Subtract Above-the-Line Deductions

These are called "above-the-line" because they appear above the AGI line on Form 1040. Unlike itemized deductions, you can claim these regardless of whether you itemize or take the standard deduction.

Common Above-the-Line Deductions for 2025:

Educator Expenses

Up to $300 for teachers ($600 if married filing jointly)

Line 11 of Schedule 1

Health Savings Account (HSA)

$4,300 individual, $8,550 family (2025 limits)

Form 8889, Line 13

Traditional IRA Contributions

Up to $7,000 ($8,000 if age 50+)

Subject to income limits

Student Loan Interest

Up to $2,500 (phases out at higher incomes)

Line 21 of Schedule 1

Self-Employment Tax

50% of self-employment tax paid

Schedule SE, Line 15

Self-Employed Health Insurance

Premiums paid for self/family

Line 17 of Schedule 1

Deep Dive: How to Fix a "High AGI" Problem

If you find your AGI is just above the threshold for a critical benefit (like the $150,000 limit for the Child Tax Credit or Roth IRA contribution limits), you need to act before the year ends.

Harvest Capital Losses

Sell investments that have lost value. You can use up to $3,000 of capital losses to offset ordinary income (like wages), directly reducing your AGI. This is a classic year-end move known as "Tax Loss Harvesting."

Defer Bonuses

If you are expecting a year-end bonus, ask your employer to pay it in January. This pushes the income (and the tax liability) to the next tax year, effectively lowering your current year's AGI.

AGI vs. MAGI: Understanding the Difference

You'll often hear about Modified Adjusted Gross Income (MAGI) in addition to AGI. While similar, MAGI adds back certain deductions and is used for specific purposes.

What Gets Added Back for MAGI:

- Student loan interest deduction

- IRA contributions (if deducted)

- Foreign earned income exclusion

- Foreign housing exclusion

When MAGI Matters:

- • ACA health insurance premium subsidies (Form 8962)

- • Roth IRA contribution eligibility

- • Traditional IRA deduction phase-outs

- • Child tax credit phase-outs

Strategies to Optimize Your AGI

Strategic AGI management can save thousands in taxes and qualify you for valuable benefits. Here are proven strategies:

1. Maximize Above-the-Line Deductions

Since these deductions reduce AGI regardless of whether you itemize, prioritize them:

- Contribute to Traditional IRA: Up to $7,000 deduction ($8,000 if 50+)

- Maximize HSA Contributions: Triple tax advantage for medical expenses

- Pay Student Loan Interest: Up to $2,500 deduction

2. Business Owner Strategies

Self-employed individuals have additional AGI optimization tools:

- SEP-IRA or Solo 401(k): Contribute up to 25% of net self-employment income

- Health Insurance Premiums: 100% deductible for self-employed

- Business Expenses: Ordinary and necessary expenses reduce business income

Common AGI Mistakes to Avoid

Even small errors in calculating AGI can lead to audit flags or missed refund opportunities. Watch out for these pitfalls:

- Confusing AGI with Taxable Income: Remember, AGI is the number before the Standard Deduction. Do not subtract your standard deduction to find your AGI.

- Missing the HSA Deadline: You can contribute to your HSA (and lower your AGI) up until the tax filing deadline (usually April 15) for the previous tax year. Many people forget this "look-back" window.

- Reporting Incorrect 1099-G Amounts: If you received a state tax refund last year, it might be taxable income this year, increasing your AGI. Check your 1099-G carefully.

- Math Errors: Simple addition mistakes are the most common reason for IRS delays. improved software usually catches this, but manual filers beware! Always double-check your arithmetic before submitting.

Quick Comparison: AGI vs. Other Metrics

To clarify where AGI fits in the tax flow, here is a direct comparison:

| Metric | Definition | Key Use Case |

|---|---|---|

| Gross Income | All income from all sources before any deductions. | Starting point. |

| AGI (Adjusted Gross) | Gross Income minus "Above-the-Line" deductions. | Determines eligibility for credits/benefits. |

| Taxable Income | AGI minus Standard/Itemized deductions. | Used to calculate actual tax owed. |

| MAGI (Modified AGI) | AGI plus certain "add-backs" (like foreign income). | Used for Roth IRA limits & ACA subsidies. |

Frequently Asked Questions (FAQ)

Is AGI the same as Net Income?

No. "Net Income" usually refers to what lands in your bank account (Take-Home Pay) after taxes are withheld. AGI is a specific tax term representing your income before tax calculation but after specific deductions. Your AGI is almost always higher than your Net Income.

Where do I find my AGI from last year?

You can find your AGI on Line 11 of your 2024 Form 1040. You will often need this number to verify your identity when e-filing your tax return for the current year. If you don't have your return, you can request a Tax Transcript from the IRS.

Can AGI be negative?

Yes. If your business losses (Schedule C) or capital losses exceed your other income, you can have a negative AGI. A negative AGI might be used to generate a Net Operating Loss (NOL) carryforward to reduce taxes in future years.

Does 401(k) contribution lower AGI?

Yes! Traditional 401(k) contributions are taken out of your paycheck before they are reported as taxable wages on your W-2 (Box 1). Therefore, they are excluded from your Gross Income entirely, which effectively lowers your AGI. This is one of the most powerful ways to reduce your AGI.