Understanding Alabama Paycheck Deductions in 2025

Calculating your take-home pay in Alabama involves more than just subtracting federal and state income taxes. The "Heart of Dixie" has a unique tax structure that includes a progressive state income tax with three brackets, but also distinct **local occupational taxes** in major cities like Birmingham and Gadsden. These local taxes applies to gross wages—meaning they are deducted *before* anything else—which can surprise workers relocating from other states.

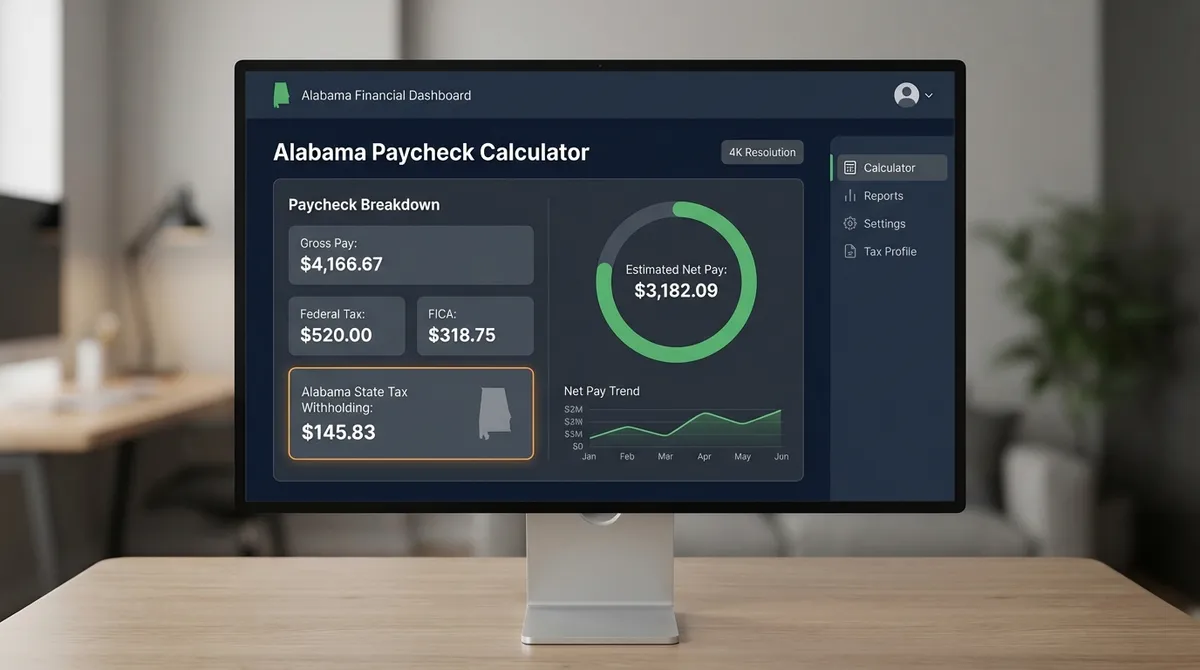

For 2025, several key federal updates also impact your bottom line. The IRS has increased standard deductions and tax bracket thresholds to account for inflation, potentially lowering your federal tax liability. Our Alabama paycheck calculator automatically factors in these 2025 updates, along with Alabama's specific $2,500 (single) or $7,500 (married) standard deductions, to give you a precise estimate of what hits your bank account each payday.

Key Statistic for 2025: An Alabama resident earning $55,000 annually (see our salary calculator) in Birmingham will see approximately **77%** of their gross pay as take-home income. This includes the impact of the 1% Birmingham occupational tax, 5% state top marginal rate, and federal withholdings.

How Alabama State Income Tax Works

Alabama uses a progressive income tax system, but it reaches its maximum rate very quickly. The top rate of 5% kicks in at just $3,000 of taxable income for single filers ($6,000 for married couples). This essentially functions like a flat tax for most full-time workers.

Alabama Tax Brackets (2025):

💡 Standard Deduction Benefit

While the tax rates kick in early, Alabama offers a standard deduction that shields some income. For 2025, Single filers get a **$2,500** deduction, and Married Filing Jointly get **$7,500**. Head of Household filers receive **$4,750**. This reduces your taxable income before rates are applied.

The Hidden Fee: Local Occupational Taxes

Unique to Alabama is the widespread use of "occupational taxes" by cities and counties. These are essentially local income taxes, but they are levied on **gross income**—meaning you pay them on your full salary before any 401(k) or insurance deductions.

Birmingham

Applied to anyone working within city limits. On a $50k salary, this costs you **$500/year**.

Gadsden

The highest rate in the state. On a $50k salary, this costs you **$1,000/year**.

Fairfield

Another major Jefferson County municipality with a local tax on gross wages.

**Pro Tip:** If you work remotely for a Birmingham company but live outside the city (and never step foot in the office), you may be exempt from this tax. Always check with your HR department about your work location status.

Federal Withholding & FICA (2025)

The largest chunk of your paycheck deduction usually goes to the IRS. For 2025, the federal tax brackets have shifted upward due to inflation adjustments, which is good news for taxpayers—it means you can earn more before moving into a higher tax bracket.

Federal Income Tax

Calculated on taxable income (after the **$15,000** Single / **$30,000** Joint standard deduction). Rates range from 10% to 37%.

FICA Taxes (The Flat 7.65%)

Mandatory contributions for Social Security and Medicare:

- **Social Security:** 6.2% on earnings up to **$176,100**.

- **Medicare:** 1.45% on all earnings (no limit).

The 2025 Alabama Overtime Exemption

In a move to incentivize hourly labor, Alabama has implemented a unique tax break: **State Income Tax Exemption for Overtime Pay**.

How It Works

If you are an hourly employee working more than 40 hours in a week, the wages paid for those hours (typically 1.5x your regular rate) are **exempt** from the 5% Alabama state income tax.

- ✓Applies to hourly workers (non-exempt).

- ✓Effective through tax year 2025 (unless renewed).

- ✓Employers must report this separately, but it puts immediate cash in your pocket.

Alabama vs. Neighboring States

How does Alabama stack up against Tennessee, Georgia, Mississippi, and Florida? It is a mixed bag of low property taxes but higher sales and occupational taxes.

| State | Income Tax Top Rate | Sales Tax (Avg Combined) | Tax Friendly? |

|---|---|---|---|

| Alabama | 5.00% + Local Occ. Taxes | 9.29% (Very High) | Mixed |

| Tennessee | 0% (None) | 9.55% | Very Friendly |

| Florida | 0% (None) | 7.02% | Very Friendly |

| Georgia | 5.49% (Flat) | 7.38% | Moderate |

| Mississippi | 4.70% (Flat) | 7.06% | Moderate |

Your Paycheck Goes Further in Alabama

While the sales tax is high, the overall cost of living in Alabama is one of the lowest in the nation. It's important to view your paycheck in the context of what it can buy.

Housing Affordability

The median home price in Alabama is roughly 50-60% of the national average. A $60,000 salary in Birmingham allows for a much higher quality of life (and homeownership!) than $100,000 in New York or California.

Property Taxes

Alabama has the 2nd lowest property tax rate in the USA (approx 0.41%). This keeps your monthly mortgage payment low, leaving more of your paycheck for savings or fun.

How to Read Your Alabama Pay Stub

Understanding your pay stub is the first step to financial literacy. Here are the specific line items Alabamians should look for:

- FED WH (Federal Withholding)This is your prepayment to the IRS. If this number is too high, you get a refund. If too low, you owe taxes in April. Adjust this with Form W-4.

- AL STATE (State Withholding)Your prepayment to the Alabama Department of Revenue. Ensure this is being deducted if you live or work in AL.

- OASDI (Social Security)Old Age, Survivors, and Disability Insurance. This is a flat 6.2% tax on your first $168,600 of income (in 2024).

- MED (Medicare)A flat 1.45% tax for senior healthcare. There is no income cap on this tax.

Case Study: Sarah in Birmingham

Let's look at Sarah, a graphic designer earning **$60,000** per year working in downtown Birmingham. She is single and contributes 5% to her 401(k).

*Note: Sarah pays $50/month purely for working in Birmingham. If she worked in Vestavia Hills (no occ tax), she would keep that $600/year.*

FAQ: Alabama Paychecks

Is overtime pay taxed differently in Alabama?▼

**Yes!** In a major legislative change, Alabama passed a law exempting overtime pay (for hourly workers working over 40 hours) from state income tax starting in 2024 and continuing through 2025. This means your overtime hours are tax-free at the *state* level (5% savings), though you still owe federal taxes and FICA on them.

Does Alabama tax 401(k) contributions?▼

Generally, no. Traditional 401(k) contributions are deducted pre-tax for both federal and Alabama state tax purposes. This lowers your taxable income on your paycheck. However, local occupational taxes (like in Birmingham) are calculated on *gross* pay, so 401(k) contributions do not lower your local tax liability.

Why is my Alabama refund smaller than expected?▼

Because Alabama's top tax rate of 5% kicks in at very low income levels ($3,000 for singles), almost all your income is taxed at the highest rate. If your employer only withholds using the standard tables without accounting for other income or fewer deductions, you might break even or owe a small amount rather than getting a large refund.

Do I pay tax if I live in Alabama but work in Georgia?▼

Yes, you are taxed on your worldwide income as an Alabama resident. You will file a non-resident return for Georgia (paying tax there) and a resident return for Alabama. Alabama will give you a credit for taxes paid to Georgia to avoid double taxation, but you must still file.