Arizona's Paycheck Tax System: Understanding Your Take-Home Pay in 2025

Arizona has transformed its tax system into one of the most straightforward and taxpayer-friendly structures in the United States. As of 2025, the Grand Canyon State features a flat income tax rate of 2.5%, no local income taxes in any city, and a simple withholding system that gives employees direct control over their paycheck deductions. Understanding how these elements work together is essential for maximizing your take-home pay and making informed financial decisions.

Whether you're a long-time Arizona resident working in Phoenix's booming tech sector, a recent transplant from California seeking tax relief, or a remote worker considering Arizona for its favorable tax climate, this comprehensive guide will walk you through every aspect of Arizona paycheck calculations. We'll explore the state's flat tax system, the simplified Form A-4 withholding process, and strategies to optimize your deductions for maximum financial benefit.

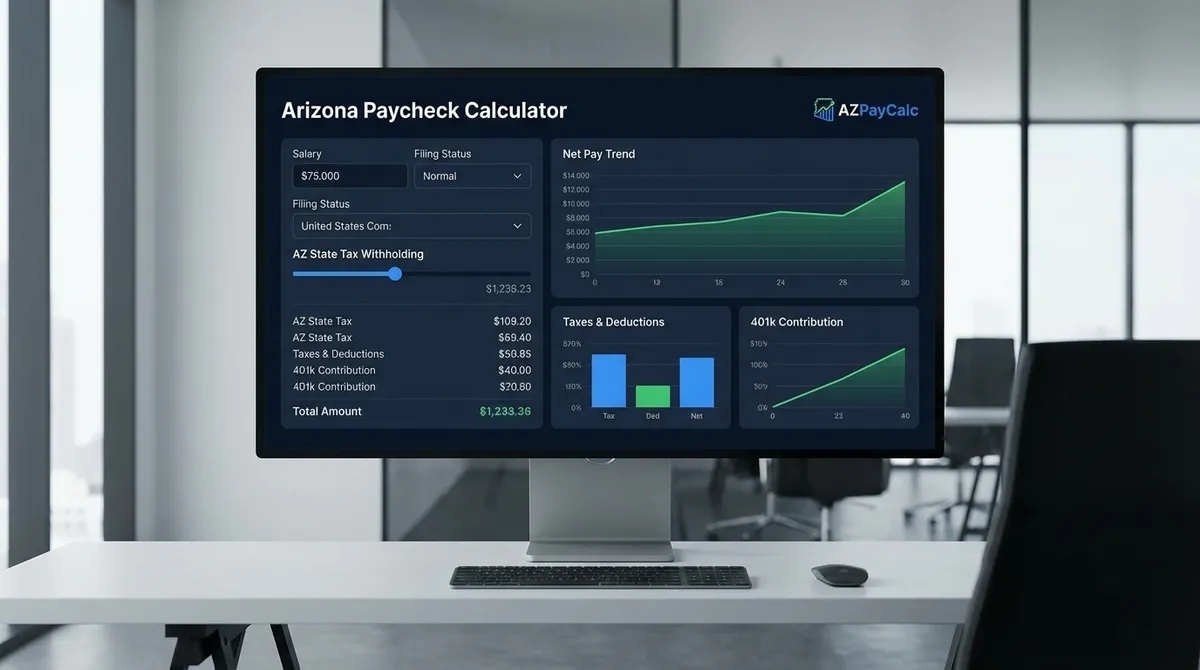

Key Fact: Arizona's 2.5% flat tax rate is among the lowest state income tax rates in the nation, and when combined with zero local income taxes, creates a powerful financial advantage for workers. A $75,000 earner saves approximately $3,000 annually compared to California and avoids the complexity of multi-jurisdictional tax calculations that plague workers in states like Ohio, Pennsylvania, and New York.

The Evolution to Arizona's Flat Tax: From Progressive Brackets to Simplicity

Arizona's journey to a flat tax system represents one of the most significant tax reforms in recent state history. Before 2023, Arizona used a progressive tax structure with four brackets ranging from 2.59% to 4.5%. While this system was already relatively low compared to many states, it created complexity in withholding calculations and tax planning.

Historical Arizona Tax Rates (Pre-2023)

- • 2.59% on income up to $27,272 (single) / $54,544 (married)

- • 3.34% on income between $27,273-$54,544 (single)

- • 4.17% on income between $54,545-$163,632 (single)

- • 4.50% on income over $163,633 (single)

The transition to a flat 2.5% rate, phased in starting in 2022 and fully implemented by 2023, simplified tax calculations dramatically. This reform had different impacts across income levels:

Low-Income Earners ($30K-$50K)

Slight reduction from 2.59% to 2.5%, saving $27-$54 annually

Middle-Income Earners ($50K-$100K)

Moderate savings from 3.34%-4.17% to 2.5%, saving $420-$1,670 annually

High-Income Earners ($100K+)

Maximum reduction from 4.5% to 2.5%, saving $2,000+ annually at $100K income

The flat tax system eliminated bracket calculations, making paycheck withholding straightforward and predictable. Employers no longer need complex withholding tables, and employees can easily verify their state tax calculations. This simplicity has been particularly beneficial for small businesses and payroll processors who previously had to navigate multi-bracket withholding systems.

Form A-4: Arizona's Simplified Withholding System

Unlike the complex withholding allowance systems used by most states and the federal W-4 form, Arizona's Form A-4 uses a refreshingly simple percentage election approach. When you start a new job or want to adjust your withholding, you complete this one-page form that asks for just a few key pieces of information.

Form A-4 Withholding Percentage Options

Only for qualified individuals meeting specific exemption criteria, such as low-income workers below filing thresholds or certain non-residents

Applied automatically if you don't submit Form A-4; results in under-withholding for most employees since actual tax is 2.5%

Matches Arizona's flat income tax rate; ideal for most single-job employees to remain tax-neutral throughout the year

For employees who want larger refunds, have multiple jobs, significant other income, or prefer forced savings through over-withholding

The genius of Form A-4 lies in its transparency. Rather than mysterious "allowances" that obscure the actual tax being withheld, Arizona employees see exactly what percentage comes out of each paycheck. This clarity empowers workers to make informed decisions about their withholding strategy.

Strategic Considerations

- • 2.5% keeps more money in your pocket year-round

- • Higher percentages create forced savings for tax refunds

- • Multiple jobs may require higher withholding

- • Adjust after major life changes

Common Scenarios

- • Single job, no other income: 2.5%

- • Married, both working: Consider 3.0-3.5%

- • Side business or rental income: 3.5-4.0%

- • Prefer large refund: 3.5-4.0% or higher

No Local Income Taxes: Arizona's Competitive Advantage

One of Arizona's most significant financial advantages is its prohibition on local income taxes. This policy, enshrined in state law, means that no city, county, or municipality can impose additional income taxes on wages. This creates a stark contrast with many other states and provides clarity and savings for Arizona workers.

Phoenix

America's 5th largest city with zero local income tax

Savings vs. Ohio cities: $750-$1,500 annually on $75K income

Tucson

Growing tech and aerospace hub, no local wage tax

Savings vs. PA cities: $375-$975 annually on $75K income

Scottsdale

Premier resort destination, tax-free for workers

Savings vs. NYC: $2,000+ annually on $75K income

Mesa

Largest suburban city, no municipal income tax

Savings vs. Indiana cities: $225-$675 annually on $75K income

Chandler

Silicon Desert tech corridor, tax-free employment

Savings vs. Maryland cities: $375-$825 annually on $75K income

Gilbert, Glendale, Tempe

All major suburbs maintain zero local income tax

Attracting CA transplants with combined state+local tax savings

States with Local Income Taxes (for comparison)

This local tax prohibition extends to all forms of wage taxation. Arizona cities cannot impose occupational privilege taxes, payroll taxes, commuter taxes, or any other form of income-based local taxation. The result is a clean, simple tax structure where workers only need to calculate state and federal obligations without worrying about city-specific rules or rates.

For businesses, this simplifies payroll processing dramatically. Companies operating in multiple Arizona locations don't need location-specific withholding tables or complex reporting for different municipalities. This administrative simplicity reduces compliance costs and eliminates a major source of payroll errors that plague businesses in locally-taxing states.

Federal Tax Components and FICA Contributions

While Arizona's tax system is simple, federal taxes remain complex and represent the largest portion of most workers' paycheck deductions. Understanding these components helps you plan more effectively and optimize your overall tax strategy. Using a paycheck calculator style breakdown can help visualize these deductions.

Federal Income Tax Withholding (2025 Rates)

Social Security Tax

- • Rate: 6.2% of wages

- • 2025 Wage Base: $176,100 (increased from $168,600 in 2024)

- • Maximum Tax: $10,918.20 annually per employee

- • Phase-out: No Social Security tax on earnings above wage base

- • Employer Match: 6.2% from employer (not from your paycheck)

- • Annual Increase: Wage base adjusts with inflation (National Average Wage Index)

Medicare Tax

- • Regular Rate: 1.45% on all wages (no wage base limit)

- • Additional Medicare: 0.9% on wages over thresholds

- • Thresholds: $200K (Single/Head/HoH), $250K (Married Joint), $125K (Married Separate)

- • Total Medicare: 2.35% on wages above thresholds

- • No Employer Match: On Additional Medicare Tax

- • Uncapped: Applies to all earnings regardless of amount

Example: Federal and FICA Calculation for $75,000 Earner

Gross Income: $75,000

Standard Deduction (Single): -$14,600 = Arizona taxable income (approx) / $60,400 federal taxable

Federal Tax: ~$9,078 (12% and 22% brackets)

Social Security: $4,650 (6.2% of $75,000, under wage base)

Medicare: $1,088 (1.45% of $75,000)

Total Federal/FICA: $14,816 (19.8% effective rate)

Plus Arizona state tax: $1,875 (2.5% of $75,000)

Strategic Pre-Tax Deductions: Maximizing Your Take-Home Pay

Pre-tax deductions are one of the most powerful tools for increasing your take-home pay while simultaneously building long-term financial security. By contributing to certain accounts before taxes are calculated, you reduce both your federal taxable income and your Arizona state taxable income, creating a double tax benefit with a single action.

401(k) Contributions

2025 Limit: $23,000 ($30,500 if age 50+)

Benefit: Reduces federal and AZ taxable income

Example: $10K contribution saves $2,450 federal + $250 AZ

Health Savings Account

2025 Limits: $4,300 individual / $8,550 family

Benefit: Triple tax advantage (deductible, grows tax-free, tax-free withdrawals)

Example: $4,300 HSA saves $1,054 federal + $108 AZ

Flexible Spending Account

2025 Limit: $3,300 health FSA

Benefit: Pre-tax medical expense payments

Example: $3,300 FSA saves $809 federal + $83 AZ

Optimization Strategy: Maximize Pre-Tax Contributions

Step 1: Maximize employer 401(k) match (free money)

Step 2: Fund HSA to maximum if eligible (best tax benefits)

Step 3: Contribute to FSA for predictable medical expenses

Step 4: Increase 401(k) beyond match if cash flow allows

Total potential savings on $75K income: $3,000+ annually in reduced taxes

The math is compelling: if you're in the 22% federal bracket and contribute $10,000 to your 401(k), you save $2,200 in federal taxes plus $250 in Arizona state taxes immediately—that's $2,450 more in your pocket through tax deferral. Your $10,000 contribution only reduces your take-home pay by $7,550, but you still save the full $10,000 for retirement.

This strategy becomes even more powerful when you consider the tax-deferred growth. Over 30 years at 7% annual returns, that $10,000 contribution grows to $76,123, while your immediate tax savings of $2,450 invested in a taxable account would only grow to $18,650 after taxes—demonstrating why pre-tax contributions are the foundation of most retirement strategies.

Real-World Arizona Paycheck Examples

Case Study 1: Sarah, Entry-Level Software Developer in Phoenix

Profile: Single, 25 years old, recent college graduate

Salary: $65,000 annually

Pay Frequency: Biweekly (26 paychecks/year)

Gross per paycheck: $2,500

401(k) contribution: 6% ($156 per paycheck)

Health insurance: $85 per paycheck (pre-tax)

Net Pay: Approximately $1,775 per paycheck ($46,150 annually)

Effective Tax Rate: ~29% federal, Arizona, FICA combined

Case Study 2: Michael & Jennifer, Married Teachers in Tucson

Profile: Married filing jointly, both 35, two children

Combined Salary: $110,000 ($55,000 each)

Pay Frequency: Monthly (both)

Gross per month: $9,166 total

Combined 403(b): $1,200 per month

Dependent care FSA: $417 per month

Net Pay: Approximately $6,450 per month ($77,400 annually)

Effective Tax Rate: ~30% combined, but $19,500 in tax-advantaged savings

Case Study 3: David, Executive Relocating from California to Scottsdale

Profile: Married, 45, high-income earner

Salary: $185,000 annually

Pay Frequency: Semi-monthly (24 paychecks/year)

Gross per paycheck: $7,708

401(k) max: $1,958 per paycheck (hits $23,000 annual limit)

HSA family: $712 per paycheck (hits HSA $8,550 annual limit)

Tax Savings Moving from CA to AZ: $8,500+ annually in state income tax

Additional Tax-Deferred Savings: $31,550 in 401(k) + HSA reduces current tax liability

Arizona vs. California: The Tax Migration Impact

The migration from California to Arizona has accelerated dramatically in recent years, with taxes playing a major role in individual and business relocation decisions. The contrast between California's progressive 13.3% top rate and Arizona's flat 2.5% rate creates compelling financial incentives.

California vs. Arizona State Tax Comparison (2025)

$50,000 Income:

CA: ~$2,000 (4%) | AZ: $1,250 (2.5%)

Arizona Savings: $750 annually

$100,000 Income:

CA: ~$6,000 (6%) | AZ: $2,500 (2.5%)

Arizona Savings: $3,500 annually

$250,000 Income:

CA: ~$20,000 (8%) | AZ: $6,250 (2.5%)

Arizona Savings: $13,750 annually

These savings multiply when you factor in California's additional taxes: a 1% mental health services tax on income over $1 million, higher sales taxes (7.25% state + local up to 10.75% vs. Arizona's 5.6% state + local), and significantly higher property taxes in many areas. The total tax difference can exceed $20,000 annually for high-income households.

Why Businesses Are Relocating Too

Arizona's business-friendly tax environment includes:

- • 4.9% corporate income tax (vs. California's 8.84%)

- • No franchise tax or business inventory tax

- • Streamlined regulatory environment

- • Lower commercial property taxes

- • Growing talent pool from in-migration

Common Arizona Paycheck Mistakes to Avoid

Mistake 1: Not Submitting Form A-4 (Default 2% Withholding)

When you don't submit Form A-4, Arizona law requires employers to withhold at 2.0%, which is less than the actual 2.5% tax rate. This creates under-withholding and results in a tax bill at year-end.

Solution: Always submit Form A-4 electing 2.5% unless you qualify for exemption or need higher withholding.

Mistake 2: Under-withholding with Multiple Jobs

Each employer withholds based on your selection, but combined income may push you into higher federal brackets. Standard withholding per job often results in underpayment.

Solution: Use IRS Tax Withholding Estimator and consider 3.5%-4.0% Arizona withholding for secondary jobs.

Mistake 3: Not Adjusting After Life Changes

Marriage, divorce, children, or spouse's job changes affect tax liability. Keeping outdated withholding elections creates over or under-payment.

Solution: Review and update Form A-4 and federal W-4 within 30 days of major life events.

Mistake 4: Overlooking Pre-Tax Benefits

Many employees don't fully utilize 401(k), HSA, FSA, or pre-tax insurance premiums, missing significant tax savings opportunities.

Solution: Calculate maximum affordable pre-tax contributions; prioritize employer match, then HSA, then additional 401(k).

Mistake 5: Confusing Pay Frequency Impact on Withholding

Employees switching from bi-weekly to monthly or vice versa sometimes think it changes tax rates. It changes withholding per paycheck but not annual tax liability.

Solution: Focus on annual tax planning; use our calculator to verify correct withholding for any pay frequency.

Mistake 6: Not Factoring in Bonus and Commission Taxation

Supplemental income is often withheld at flat rates (22% federal, 2.5% Arizona) which may not match your actual marginal tax rate, creating discrepancies.

Solution: Adjust regular withholding or make estimated tax payments if bonus withholding is significantly different from your marginal tax rate.

Frequently Asked Questions

What is the Arizona state income tax rate for 2025?

Arizona uses a flat income tax rate of 2.5% for all taxable income levels and filing statuses. This rate applies to wages earned in 2025. For more details, visit the Arizona Department of Revenue.

Does Arizona have local or city income taxes?

No. Unlike states such as Ohio or Pennsylvania, Arizona state law prohibits cities and counties from imposing local income taxes on wages. You only pay federal and state income tax.

What happens if I don't submit Arizona Form A-4?

If you fail to submit Form A-4 to your employer, they are required by law to withhold Arizona tax at a default rate of 2.0%. Since the actual tax rate is 2.5%, this usually results in owing taxes when you file your return. It is highly recommended to submit the form and elect 2.5%.

How do 401(k) contributions affect my Arizona taxes?

Contributions to a traditional 401(k), 403(b), or TSP are made pre-tax for both federal and Arizona purposes. This means every dollar you contribute reduces your Arizona taxable income, saving you 2.5% in state taxes on that amount immediately.

Is the Arizona rebate or tax refund taxable?

Generally, state tax refunds are only taxable on your federal return if you itemized deductions in the previous year and received a tax benefit from deducting state taxes. The recent Arizona Families Tax Rebate (from 2023) had specific IRS rulings, so checking current guidelines for any new rebates is always wise.

What is the Social Security wage base for 2025?

For 2025, the Social Security wage base is $176,100. You pay 6.2% tax on earnings up to this limit. Any earnings above $176,100 are exempt from Social Security tax, though Medicare tax (1.45%) still applies to all income.

Key Takeaways: Maximizing Your Arizona Paycheck

Arizona Tax Advantages

- • Flat 2.5% state income tax (simple, predictable)

- • No local income taxes (Phoenix, Tucson, Mesa, all cities)

- • Easy Form A-4 percentage election

- • No complex multi-jurisdictional calculations

Optimization Strategies

- • Maximize pre-tax 401(k), HSA, FSA contributions

- • Choose 2.5% withholding on Form A-4 for most situations

- • Update withholding after life changes

- • Use calculator to verify accuracy regularly

Understanding your Arizona paycheck is fundamental to effective financial planning. The Grand Canyon State's taxpayer-friendly policies—featuring a low flat tax rate, absence of local income taxes, and simplified withholding system—create an environment where you can keep more of your hard-earned money. However, these advantages only benefit you if you understand how to calculate your take-home pay accurately and optimize your withholding elections.

Regular use of our Arizona paycheck calculator helps you stay informed about your actual tax liability, experiment with different withholding scenarios, and quantify the impact of pre-tax deductions on your take-home pay. By taking control of your paycheck calculations, you can maximize your monthly cash flow while building long-term financial security through strategic tax-advantaged savings.

Whether you're evaluating a job offer, planning for retirement, considering a move to Arizona, or simply wanting to understand where your money goes each month, this comprehensive tool provides the accuracy and insight needed for confident financial decision-making. Arizona's favorable tax climate, combined with smart financial planning, creates opportunities for residents to build wealth faster and achieve their financial goals sooner than in higher-tax states.