Understanding Auto Loan APR: The True Cost of Vehicle Financing in 2025

Auto loan APR reveals the genuine annual cost of borrowing money to purchase a vehicle, encompassing both interest charges and mandatory lender fees. While dealerships prominently advertise attractive interest rates to capture attention, these figures conceal the true financial impact of origination fees, documentation charges, title costs, and other expenses that comprise your Annual Percentage Rate. Understanding this distinction empowers you to compare loan offers accurately and potentially save thousands over your loan term.

In 2025's automotive financing landscape—with average new car rates at 6.73% and used vehicles at 11.87%—comprehending APR mechanics isn't optional financial literacy; it's essential consumer protection. Credit score tiers dramatically impact your rate: borrowers with 750+ scores secure rates below 6%, while subprime borrowers face rates exceeding 15%. This guide transforms you into an informed negotiator who can identify hidden costs and secure genuinely competitive financing.

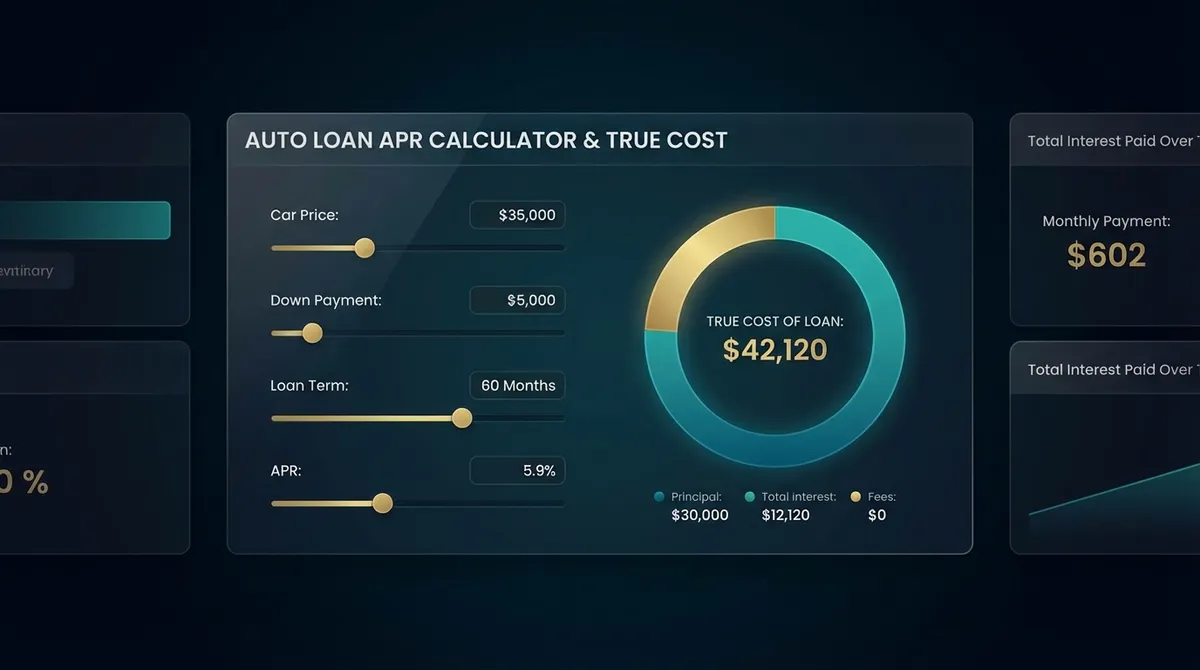

Key Statistic: On a $35,000 auto loan over 60 months, the difference between 6% APR and 9% APR equals $3,030 in additional interest—a 54% cost increase. The gap widens further when fees push effective APR to 11%+, potentially costing over $6,000 more compared to competitive financing.

APR vs Interest Rate: The Critical Distinction That Costs You Money

The interest rate represents merely the cost of borrowing principal amount, expressed as a percentage. APR (Annual Percentage Rate) includes interest rate plus ALL lender-imposed fees and charges, revealing the true annual cost of financing. This difference isn't semantic—it's financial, often totaling thousands of dollars.

The Costly Confusion

Dealerships exploit this confusion by advertising "7.99% interest rates!" while loading loans with fees that push APR to 10.5%+. Federal Truth in Lending Act requires APR disclosure, but lenders bury it in fine print while emphasizing the lower interest rate in marketing materials.

Interest Rate Only:

- • Cost of borrowing principal

- • Excludes all fees

- • Lower marketing number

- • Doesn't reflect reality

APR (True Cost):

- • Includes interest rate

- • Plus origination fees

- • Plus documentation fees

- • Plus title/registration

- • Plus all finance charges

- • Legally required disclosure

Current 2025 Auto Loan Rates by Credit Tier

Real-World Rate Ranges (Experian Q1 2025 Data)

| Credit Score | Category | New Car Avg | Used Car Avg | +Typical Fees APR |

|---|---|---|---|---|

| 781-850 | Super Prime | 5.27% | 7.15% | 6.5-7.5% |

| 661-780 | Prime | 6.78% | 9.39% | 8-10% |

| 601-660 | Non-Prime | 9.97% | 13.95% | 11-15% |

| 501-600 | Subprime | 13.38% | 18.90% | 15-20% |

| 300-500 | Deep Subprime | 15.97% | 21.58% | 18-25% |

Note: The "+Typical Fees APR" column shows realistic APR ranges after including origination, documentation, and title fees. Credit unions typically offer 0.5-1% lower rates than banks.

How APR Is Calculated: The Complete Formula

APR calculation follows standardized methodology under the Truth in Lending Act, incorporating all finance charges over the loan term. The fundamental approach: APR represents the interest rate that would produce the same total cost if all fees were instead included in the interest rate.

- •Total Finance Charges: Sum of all interest paid plus ALL fees (origination, documentation, title, registration, credit insurance, gap coverage)

- •Loan Amount: Principal amount actually financed (vehicle price minus down payment plus any fees rolled into loan)

- •Loan Term: Duration in years (e.g., 60 months = 5 years)

- •Actual Calculation: Lenders use iterative methods to solve for the rate that amortizes the loan amount to equal total payments including fees

In practice, exact APR calculation requires sophisticated amortization software because fees may be paid upfront or rolled into the loan, affecting the amount financed and payment schedule. Our calculator automates this complex math.

Real-World APR Comparison: $30,000 Auto Loan Analysis

Let's analyze three actual loan offers for a $30,000 vehicle purchase with $5,000 down payment (financing $25,000). This demonstrates why APR comparison—not interest rate—is essential for identifying the best deal.

Loan Scenario: 60-Month Term Financing

| Loan Feature | Dealer Offer | Bank Offer | Credit Union |

|---|---|---|---|

| Advertised Rate | 6.99% | 7.49% | 7.19% |

| Origination Fee | $1,200 | $500 | $200 |

| Documentation Fee | $400 | $300 | $150 |

| Monthly Payment | $517 | $483 | $475 |

| TRUE APR | 8.74% | 7.89% | 7.45% |

| Total Interest + Fees | $7,890 | $6,240 | $5,720 |

💡 Critical Insight: The dealer's "lowest" 6.99% interest rate actually costs $2,170 MORE than the credit union's 7.45% APR offer. This demonstrates why APR comparison is crucial for making informed decisions.

Common Auto Loan Fees That Inflate Your APR

Origination Fees

Typically 0.5% to 1.5% of loan amount ($150-$750 on average). This fee covers loan processing, paperwork, and administrative overhead. Some lenders waive this fee for borrowers with credit scores above 740 or during promotional periods.

Negotiation tip: Ask lenders to reduce or eliminate origination fees, especially if you have competing offers. Credit unions rarely charge these fees.

Documentation Fees

Range from $150 to $500 depending on lender and state regulations. These cover preparing and processing loan documents. Some states cap these fees (California limits to $85), while others allow market rates.

Action item: Always request itemized fee breakdowns. Question fees exceeding $300 and compare across multiple lenders.

Title & Registration Fees

Government-mandated fees typically $200-$600 depending on state and vehicle value. These are non-negotiable but must be disclosed in APR calculations. Electric vehicles may incur additional registration fees in some states.

Important: Verify these fees match your state's DMV published rates. Dealers sometimes add "processing" markups to mandatory fees.

Credit Insurance & Gap Coverage

Optional products that add $500-$1,500 to your loan. Credit life insurance, disability insurance, and guaranteed asset protection (GAP) coverage increases APR significantly. While sometimes beneficial, evaluate these separately from core financing.

Expert advice: Compare standalone GAP insurance policies (often $200-$400) vs. lender-offered coverage. Credit insurance rarely provides good value.

💡 Expert Strategies to Secure Lower APR from Jurica Šinko

1. Get Pre-Approved Before Visiting Dealers

Secure financing from your bank or credit union before dealership visits. This establishes a baseline APR for comparison and gives negotiation leverage. Pre-approvals typically result in 0.5-1.5% lower APR than dealer-arranged financing. Walking in with a check from your lender eliminates dealer markups and high-pressure finance office tactics.

2. Negotiate Each Fee Separately

Don't accept "that's standard" responses. Origination fees above 1% are negotiable. Documentation fees above $300 should be questioned. Request written justification for each charge. Multiple lenders competing for your business creates leverage—mention better offers you've received to pressure current lender to reduce fees.

3. Optimize Your Credit Profile 30-60 Days Before Applying

Pay down credit card balances below 30% utilization (ideally below 10%). Don't close old accounts—average account age impacts scores. Avoid new credit inquiries 60 days before application. Correct any credit report errors through official dispute processes. These steps can boost your score 50-100 points, potentially lowering APR by 2-4%.

4. Shorter Loan Terms Equal Lower APR

While 72-84 month loans offer lower monthly payments, they typically carry 1-2% higher APR and significantly increase total interest costs. Opt for 48-60 month terms when possible—the APR is usually 0.5-1% lower, and you'll save thousands in total interest. Calculate total loan cost, not just monthly payment, when comparing terms.

5. Time Your Application Strategically

Apply during month-end when sales quotas pressure dealers to offer better rates. December often brings manufacturer incentives and year-end clearance pricing. Monitor Federal Reserve rate announcements—applying shortly after rate cuts can secure lower APR. Avoid applying during peak car-buying seasons (spring) when demand is highest and rates less competitive.

6. Leverage Relationship Banking

Existing customers often receive 0.25-0.5% APR discounts. If you have checking, savings, or mortgage accounts with a bank, ask about relationship pricing. Credit unions typically offer 0.5-1% lower rates than banks and are more flexible with approval criteria. Membership is often available based on location, employer, or small donation to affiliated organizations.

⚠️ Common APR Mistakes That Cost Thousands

Mistake 1: Comparing Interest Rates Instead of APR

This fundamental error costs car buyers an average of $2,400 per loan. Dealerships exploit this by advertising low interest rates while loading loans with fees. Always demand written APR quotes from all lenders and compare these figures exclusively. The Truth in Lending Act mandates APR disclosure—use it. For more info, visit the Consumer Financial Protection Bureau.

Mistake 2: Focusing on Monthly Payment Over Total Cost

Extending loan terms to 72-84 months lowers payments but increases APR and total interest dramatically. A $30,000 car at 7% APR costs $34,474 total with 60-month financing, but $37,392 with 84-month terms—despite lower monthly payments. Calculate total loan cost including all interest and fees before signing. See our amortization calculator for scenarios.

Mistake 3: Accepting Dealer "Standard" Fees Without Question

Documentation fees exceeding $400, "dealer prep" charges of $500+, and mandatory add-on products like VIN etching ($200) or paint protection ($600) can add $1,500-$3,000 to your loan. Many of these fees are negotiable or optional. Always request itemized fee breakdowns and challenge charges that seem excessive or unnecessary.

Mistake 4: Ignoring Prepayment Penalties

Some subprime lenders include prepayment penalties of 2% of remaining balance if you pay off the loan early—either through refinancing or accelerated payments. This trap prevents you from escaping high APR when your credit improves. Always read loan terms carefully and negotiate removal of prepayment penalties before signing.

Mistake 5: Rolling Negative Equity into New Loans

Trading in a vehicle you owe more than it's worth (negative equity) and rolling the deficit into a new loan immediately puts you underwater. This practice increases your loan amount, raises APR due to higher risk, and traps you in a cycle of perpetual debt. Wait until you have positive equity or pay the difference in cash before trading vehicles.

Why APR Transparency Matters for Your Financial Health

Understanding auto loan APR transcends simple car buying—it represents a fundamental shift toward financial empowerment and consumer protection. When you comprehend how fees, interest rates, and loan terms interact to create your true borrowing cost, you transform from a passive payment-maker into an active financial strategist.

The automotive financing industry thrives on complexity and consumer confusion. Dealerships generate significant profits through finance departments, often marking up lender rates by 1-3% and layering on discretionary fees. By understanding APR mechanics and using our calculator to reveal true costs, you protect yourself from predatory practices and ensure every dollar spent on transportation serves your broader financial goals rather than padding dealership profit margins.

Your Action Plan: From APR Awareness to Optimal Financing

Use Our APR Calculator to Benchmark True Costs

Input your specific loan offers, including all fees, to calculate accurate APR for true comparison. Print or save results to use as negotiation leverage.

Secure Multiple Pre-Approvals Before Shopping

Obtain written APR quotes from 3-4 lenders including your bank, a credit union, and online lenders. These become your baseline for dealer negotiations.

Negotiate Each Fee Separately

When reviewing loan offers, question fees above industry norms. Request written justification and use competing offers to pressure lenders for reductions.

Focus on Total Loan Cost, Not Monthly Payment

Calculate total amount paid over loan term including all interest and fees. Shorter terms (48-60 months) mean lower APR and significant total savings.

Review and Optimize Your Credit Profile

Address credit report errors, pay down balances below 30% utilization, and avoid new inquiries 60 days before application. These actions can reduce APR by 2-4%.

Conclusion: APR Mastery Equals Financial Empowerment

Auto loan APR represents far more than a technical finance term—it embodies the difference between informed decision-making and costly mistakes. When you understand how fees, interest rates, and loan structures converge to create your true borrowing cost, you fundamentally shift the power dynamic in automotive financing.

The automotive industry's complexity serves dealership profit margins, not consumer interests. By leveraging our comprehensive APR calculator and applying the strategies outlined in this guide, you transform from a passive payment-maker into an active financial strategist. This empowerment translates directly into tangible savings—typically $2,000-$4,000 per loan—and protects you from predatory practices that trap uninformed buyers in unnecessarily expensive financing.

Your journey toward optimal auto financing begins with a single calculation. Use our auto loan calculator below to analyze your specific loan offers, identify hidden costs, and secure the transparent, competitive financing you deserve. Every dollar saved on your auto loan is a dollar that can build your future wealth.