Financing a boat is a significant lifestyle investment that requires careful financial planning. Unlike a car purchase, buying a boat involves specialized marine lending requirements, unique documentation like Coast Guard registration, and distinct ownership costs. Whether you are eyeing a pontoon for family weekends or a center console for offshore fishing, understanding the nuances of boat loans is critical to securing the best rates in 2025.

What You'll Learn in This Guide

- Current 2025 boat loan rates

- Down payment & term options

- Marine survey requirements

- True cost of ownership

- Coast Guard documentation

- Avoiding common financing mistakes

How Boat Loans Work in 2025

Boat loans are a hybrid between auto loans and mortgages. Like a car loan, they are fixed-term installment loans. Like a mortgage, they are often for large amounts with long terms (up to 20 years) and tax-deductible interest (in specific cases). The boat itself serves as collateral for the loan. Use our general loan calculator to compare different terms.

Market Update: As of late 2025, boat loan rates for excellent credit (740+) start around 6.24% APR for new vessels. Used boat rates are typically 0.50% - 1.00% higher.

Key Loan Terms Explained

- Loan Term:Typically 10-20 years. Longer terms lower your monthly payment but increase total interest paid. Terms under $25,000 may be limited to 5-10 years (similar to personal loans).

- Down Payment:Expect to put down 10-20%. Loans over $100,000 may require 20-30%.

- Collateral:The boat is the collateral. Lenders can repossess it if payments are missed.

Marine Surveys & Documentation

Unlike cars, buying a used boat almost always requires a Marine Survey. This is a professional inspection of the hull, engine, and systems.

- Cost: Approx. $20-$25 per foot.

- Requirement: Mandatory for most lenders on used boats.

- Benefit: Identifies hidden damage that could cost thousands later.

For larger vessels (5+ net tons), lenders will require US Coast Guard Documentation. This is a federal registration that provides a clear chain of title and is preferred by marine lenders over simple state titles. Learn more at Discover Boating.

Tax Deductibility

Good news: Your boat loan interest might be tax-deductible! If the boat has a sleeping berth, galley (kitchen), and head (toilet), the IRS may consider it a "second home." This allows you to deduct the mortgage interest on your taxes, subject to standard limits. Consult a tax professional to confirm eligibility.

Common Financing Mistakes

Ignoring Maintenance

Annual maintenance costs are ~10% of the boat value. Don't stretch your budget max on the payment alone. Check your [object Object] first.

Skipping Pre-Approval

Get pre-approved to know your real budget and negotiate cash prices with sellers.

Forgetting Insurance

Marine insurance is specialized and can be 1.5% - 3% of the boat value annually.

Short Terms on Big Loans

Taking a 5-year term on a $100k loan creates a massive monthly payment. Use a longer term and pay extra to shorten it flexibly.

Factors Affecting Boat Loan Rates

Securing a competitive interest rate for your boat loan depends on several key factors. Lenders evaluate your financial profile and the boat itself to determine the risk level. High-credit borrowers can see rates 2-3% lower than subprime borrowers, translating to thousands in savings. (See how simple interest works).

- Credit Score: A higher credit score (740+) typically qualifies you for lower interest rates.

- Loan Amount and Term: Larger loans or longer repayment terms might come with different rate structures. Typically, shorter terms have lower rates but higher monthly payments.

- Down Payment: A larger down payment (e.g., 20-30%) reduces the lender's risk and can help you secure a better rate.

- Boat Age and Type: Newer boats generally qualify for lower rates compared to older vessels. Liveaboards or wood-hull boats may be harder to finance.

- Debt-to-Income Ratio: Lenders look at your DTI to ensure you can comfortably afford the new loan payments alongside your existing obligations. Ideally, keep DTI under 40% (calculate yours with our DTI calculator).

Hidden Costs of Boat Ownership

When calculating your budget, remember that the loan payment is just the beginning. The total cost of ownership includes recurring expenses that can add up quickly:

- Insurance: Boat insurance costs about 1.5% of the boat's value annually.

- Storage and Mooring: Marina fees vary wildly but can range from $1,000 to $10,000+ per year.

- Maintenance and Repairs: Budget 10% of the boat's value annually for maintenance, repairs, and winterization.

- Fuel: Marine fuel is expensive. A day on the water can easily cost $100-$300 in fuel depending on the boat.

- Registration and Taxes: Don't forget state registration fees and personal property taxes (if applicable in your state).

How to Negotiate the Best Boat Loan Rates

Don't accept the first offer you receive. Boat financing is competitive, and you can often secure better terms with a strategic approach:

- Get Pre-Approved: Secure a pre-approval from an online lender or credit union before visiting the dealership. This gives you a baseline to meaningful negotiate with the dealer's finance department.

- Shop Seasonally: Lenders and dealers are often more eager to close deals in the off-season (late fall and winter) compared to the peak spring buying season.

- Fix Your Credit First: If your score is on the borderline (e.g., 690), paying down a small credit card balance to boost it over 700 could save you 0.50% in interest.

- Consider a shorter term: If you can afford the higher monthly payment, a 10-year term often carries a lower rate than a 15 or 20-year term, saving you thousands in total interest.

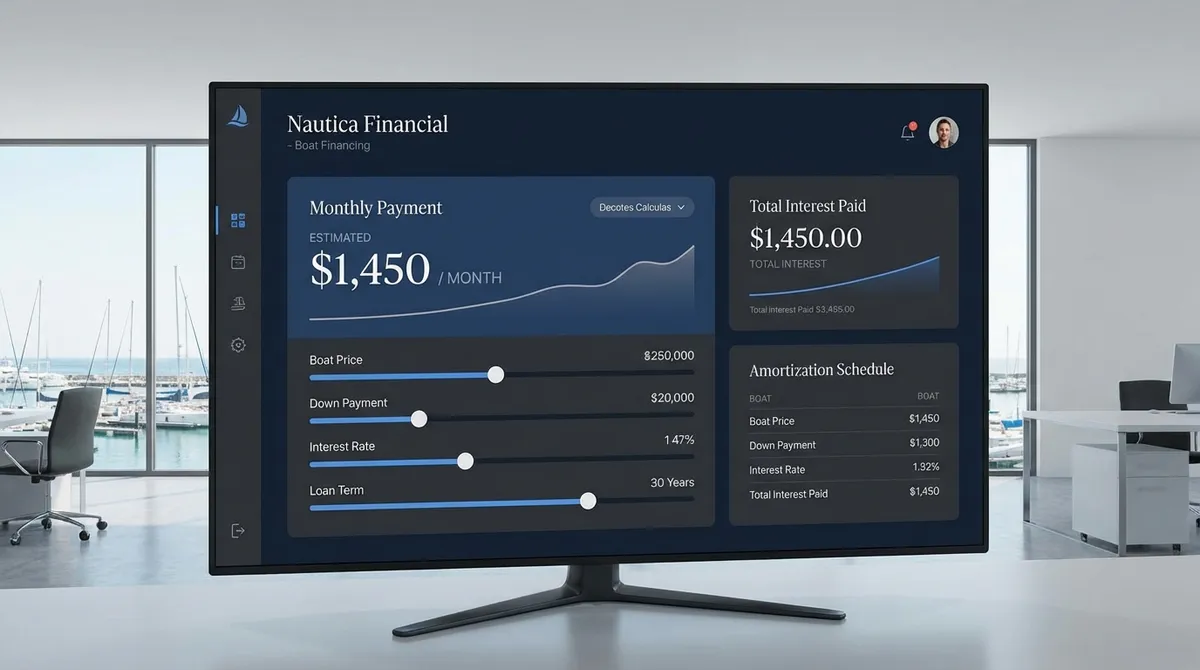

How to Use This Calculator

Enter Price

Input the negotiated purchase price of the vessel.

Set Down Payment

Aim for 10-20%. A higher down payment lowers your rate.

Add Fees

Include estimated survey ($22/ft) and documentation costs.

Review

Check the amortization schedule to see your long-term cost.

Frequently Asked Questions

Can I refinance a boat loan?

Yes, boat loan refinancing is common. If interest rates drop or your credit score improves, you can refinance to a lower rate or change the term. However, keep in mind that unlike home mortgages, boat values depreciate, so ensure you aren't 'underwater' on the loan before applying.

What credit score do I need for a boat loan?

Most marine lenders look for a score of 680 or higher. For the best rates (under 7%), you typically need a score of 740+. Lenders also scrutinize your debt-to-income ratio.

How long can I finance a boat?

Terms depend on the loan amount. Loans under $25,000 might be capped at 10 years. Loans over $100,000 often go up to 20 years. 15 years is the standard for most mid-sized recreational boats.

Is boat interest tax deductible?

Potentially yes. If the boat qualifies as a second home (sleeping, cooking, toilet facilities) and is security for the loan, you can often deduct the interest on Schedule A.

Do I need a survey for a new boat?

Usually no. New boats are covered by warranty. However, nearly all lenders require a marine survey for used boats to verify value and seaworthiness.

Can I include the trailer in the loan?

Yes, the trailer, motor, and boat are typically financed together as a package. Make sure the bill of sale lists all three.

What is the typical down payment?

10% to 20% is standard. Zero-down programs are rare and usually come with significantly higher interest rates.

About the Author

Jurica Šinko is a marine finance specialist with over 15 years of experience helping buyers navigate boat loans, insurance, and ownership costs.