What Is a Cash-Out Refinance and How Does It Work?

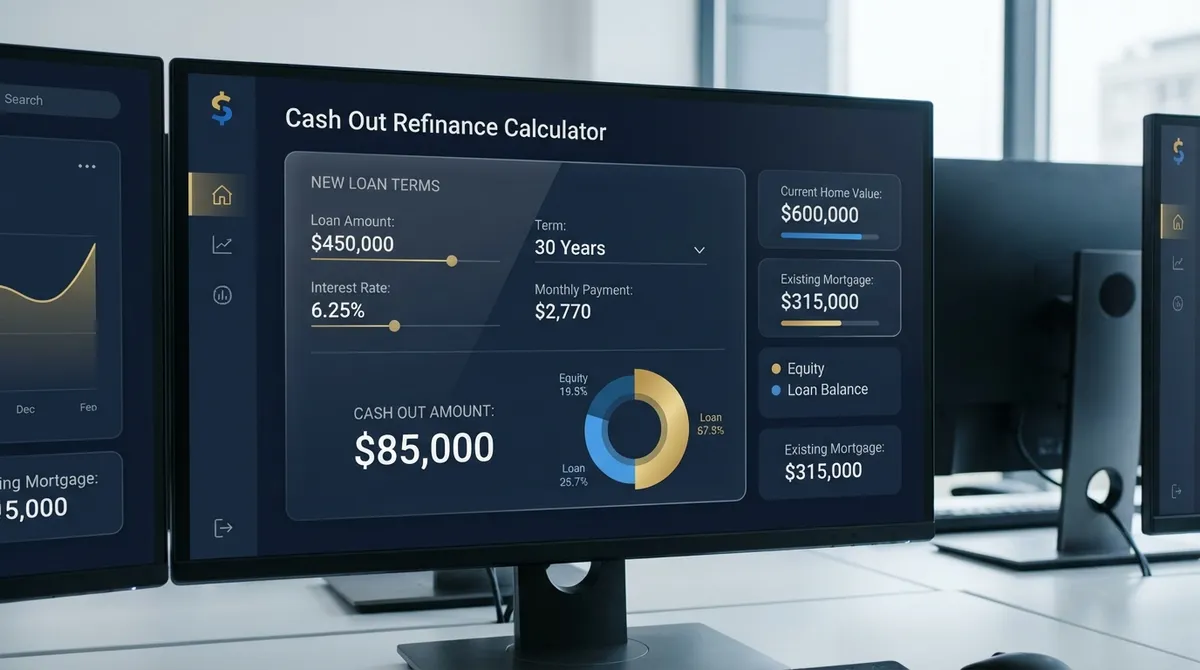

A cash-out refinance allows you to tap into your home's equity by replacing your existing mortgage with a larger loan. The difference between your old and new loan balance is paid to you in cash at closing. This is different from a regular rate-and-term refinance (which only adjusts your rate and/or term) because you're extracting equity and increasing your loan principal. Use our mortgage calculator to compare scenarios.

Understanding LTV and Cash-Out Limits

The most critical factor in cash-out refinancing is your Loan-to-Value (LTV) ratio. Lenders impose strict limits because they're taking on more risk when you borrow against your equity. For conventional loans, the maximum you can borrow is 80% of your home's appraised value.

LTV Formula: Available Cash = (Home Value × Max LTV) - Current Mortgage Balance

Conventional Loan

Maximum LTV: 80%

Minimum equity: 20%

Most common option

FHA Loan

Maximum LTV: 80% (current policy)

MIP required

More lenient credit

VA Loan

Maximum LTV: up to 90–100% (lender policies vary)

No PMI

Only for veterans

Real Example:

Your home is worth $500,000. You owe $300,000 on your current mortgage. With 80% LTV limit, you can borrow up to $400,000 total. Since you currently owe $300,000, you could potentially access $100,000 in cash minus closing costs.

When Does a Cash-Out Refinance Make Sense?

When It's a Smart Move

- •Home improvements that increase value: Kitchen remodel, bathroom upgrade, or adding square footage typically provides ROI that exceeds borrowing costs.

- •High-interest debt consolidation: Paying off 18-25% APR credit cards with 6-7% mortgage interest can save thousands, plus interest may be tax-deductible. Check your potential savings with our debt consolidation calculator.

- •Investment in income-producing assets: Down payment on rental property or starting a business where returns exceed borrowing costs.

- •Emergency fund for stability: Medical emergencies, job loss buffer, or other situations where liquidity prevents worse outcomes.

- •Rate reduction plus cash: If you can lower your rate AND get cash, the math is compelling even with higher balance.

When to Avoid It

- •Consumer spending: Vacations, weddings, cars, or luxury items that don't build wealth. You're converting secured debt (home) to fund depreciating assets.

- •Speculative investments: Cryptocurrency, penny stocks, or any investment where you could lose borrowed funds and still owe the mortgage.

- •Short-term cash flow issues: If income problems are temporary, a HELOC offers more flexibility than permanently increasing your mortgage.

- •Extending loan term significantly: If you have 15 years left and refinance to 30 years, you may pay MORE interest overall despite lower rate.

The Math: Breaking Down the Costs

Cash-out refinancing isn't free. Understanding the total cost helps you make informed decisions. Let's break down where your money goes:

| Cost Item | Typical Amount | Can You Negotiate? | Notes |

|---|---|---|---|

| Appraisal Fee | $500 - $1,000 | No | Required for most loans; shop around if lender allows |

| Title Search & Insurance | $1,000 - $2,500 | Sometimes | Shop title companies; reissue rate if recent purchase |

| Origination Fee | 0.5% - 1.0% of loan | Yes | Lender profit; negotiate or shop lenders |

| Points | Optional, 1% per point | Yes | Buy down rate; calculate breakeven before buying |

| Recording Fees | $50 - $500 | No | County fees; fixed cost |

| TOTAL | 2% - 6% of loan amount | $2,000 - $12,000 typical | Negotiate and shop to minimize costs |

Real-World Example: The Johnson Family's Decision

The Situation: The Johnsons own a home worth $450,000. They owe $270,000 on their current mortgage at 4.75% with 22 years remaining. Their monthly payment is $1,650. They need $60,000 for a kitchen remodel that will increase home value.

Current Mortgage

- • Home Value: $450,000

- • Balance: $270,000

- • Interest Rate: 4.75%

- • Monthly Payment: $1,650

- • Remaining Term: 22 years

- • Current LTV: 60%

- • Available Equity: $180,000

Cash-Out Refinance Option

- • New Loan Amount: $336,000

- • Interest Rate: 6.25% (higher due to cash-out)

- • New Monthly Payment: $2,068

- • New Term: 30 years

- • Cash Received: $54,000

- • New LTV: 74.7%

- • Closing Costs: $6,000

The Analysis:

Payment Impact: Monthly payment increases by $418/month, but they also reset the loan term from 22 to 30 years, extending their mortgage by 8 years.

Total Cost: Over the new 30-year term, they'll pay $408,480 in interest vs. remaining $165,000 on their current loan—a difference of $243,480, but this includes the $60,000 they accessed.

Net Cost: Adjusting for the cash received, the effective borrowing cost is about $183,480 over 30 years, or roughly 3.7% APR on the $54,000 they netted.

Recommended Decision

Proceed if: Kitchen remodel adds $40,000+ in value, they plan to stay 7+ years, and the improved functionality justifies the $418/month increase.Alternative: Consider a HELOC at 8% for just the $60,000 need, keeping their existing 4.75% mortgage intact.

Rate Shopping & Lender Comparison

Cash-out refinance rates vary significantly between lenders. Always get at least 3-4 quotes. Here's what to compare:

What to Compare

- Interest Rate: Lower is better, but not the only factor

- APR: Includes fees—more accurate comparison. See our APR calculator.

- Points: Optional, calculate breakeven before buying

- Origination Fee: Negotiable lender profit margin

- Third-Party Fees: Title, appraisal, attorney (can shop some)

- PMI Requirements: If LTV exceeds 80%

- Rate Lock Period: How long your quoted rate is valid

Red Flags to Avoid

- Too Good to Be True Rates: Teaser rates with massive points

- Pressure Tactics: "Rate expires today" urgency

- Hidden Fees: Read the Loan Estimate carefully

- Yield Spread Premium: Lender gets paid for higher rate

- Unusually High Prepayment Penalty: Avoid if possible

- Bait-and-Switch: Rate changes at closing without explanation

2025 Market Conditions & Rate Outlook

As of late 2025, mortgage rates have stabilized in the 6-7% range for conventional cash-out refinances, after the volatility of 2023-2024. The Federal Reserve's monetary policy has found equilibrium, and inflation has moderated to near the 2% target.

Current Rate Environment

- • 30-Year Fixed Cash-Out: 6.25% - 7.00%

- • 15-Year Fixed Cash-Out: 5.75% - 6.50%

- • FHA Cash-Out: 6.00% - 6.75%

- • VA Cash-Out: 5.75% - 6.50%

- • Jumbo Cash-Out: 6.50% - 7.25%

What Drives Your Rate?

- • Credit Score: 760+ gets best rates, each 20-point drop adds ~0.125%

- • LTV Ratio: 60% LTV gets better rates than 80% LTV

- • Loan Amount: Conforming loans ($806,500 max in 2025) vs. Jumbo

- • Property Type: Primary residence gets best rates

- • Debt-to-Income: Under 36% is ideal, up to 50% accepted

2025 Outlook:

Rates are expected to remain relatively stable through 2025, with potential modest declines if economic conditions soften. However, cash-out refinances typically carry a 0.25-0.50% premium over rate-and-term refinances due to higher lender risk. If you're considering a cash-out refinance, waiting for dramatically lower rates may not be productive—the 80% LTV limit and your available equity are more important factors.

Tax Implications: What Interest Is Deductible?

The 2017 Tax Cuts and Jobs Act changed the rules for mortgage interest deductibility. Here's what you need to know for 2025. You can verify this on the IRS website.

| Use of Cash-Out Proceeds | Interest Deductibility | IRS Documentation Required | 2025 Limits |

|---|---|---|---|

| Home improvements | Fully Deductible | Receipts, contracts, before/after photos | Up to $750,000 loan limit |

| Debt consolidation | Not Deductible | N/A | Personal interest exclusion |

| Investment property down payment | Not Deductible | N/A | Investment interest separate |

| Business expenses | Not Deductible | N/A | Business interest separate |

| Medical expenses | Not Deductible | N/A | May qualify for medical deduction separately |

Tax Planning Strategy

If you're using cash-out proceeds for mixed purposes (some home improvements, some debt consolidation), the IRS requires you to allocate interest proportionally. Only the portion used for home improvements is deductible.

Important: Keep meticulous records for at least 7 years. If audited, you'll need to prove exactly how you used the cash-out proceeds. Consider a separate bank account to track the funds and maintain receipts.

Cash-Out Refinance vs. Alternatives

Before committing to a cash-out refinance, compare your options. Each has pros and cons depending on your situation:

| Loan Type | Interest Rate | Closing Costs | Flexibility | Best For |

|---|---|---|---|---|

| Cash-Out Refinance | 6.25% - 7.00% | $4,000 - $12,000 | Lump sum only | Large amounts, rate reduction possible |

| HELOC | 7.00% - 9.00% | $0 - $500 | Draw as needed | Ongoing projects, emergency fund |

| Home Equity Loan | 6.75% - 8.50% | $500 - $2,000 | Fixed lump sum | One-time need, keep first mortgage |

| Personal Loan | 8.00% - 25.00% | 0% - 8% origination | Fixed lump sum | Small amounts, no collateral risk |

| Credit Cards | 18.00% - 29.99% | None (annual fees may apply) | Revolving line | Only for true emergencies |

Pre-Application Checklist: Are You Ready?

Before applying for a cash-out refinance, gather these documents and verify your qualifications:

Financial Documents

- • Last 2 years W-2s or 1099s

- • Last 2 months pay stubs

- • Last 2 months bank statements (all accounts)

- • Last 2 years tax returns (personal & business if self-employed)

- • Current mortgage statement

- • Homeowners insurance declaration page

- • HOA documentation (if applicable)

- • Proof of additional income (rental, alimony, etc.)

Qualification Checkpoints

- • Credit score: 620+ minimum, 680+ recommended

- • LTV ratio: Below 80% maximum

- • DTI ratio: Below 43-45% (up to 50% with some lenders)

- • Employment: 2+ years at same job or same field

- • Income: Stable and documentable

- • Home value: Supports desired loan amount

- • Payment history: No 30-day late payments in last 12 months

Credit Score Improvement Tip

If your credit score is below 680, consider delaying your application while you improve it. Pay down credit cards to below 30% utilization, dispute any errors on your credit report, and avoid new credit inquiries for 6 months. A 20-point score increase can save you 0.125% on your rate, which equals $12,000 over 30 years on a $400,000 loan.

Final Thoughts: Making the Right Decision

A cash-out refinance can be a powerful financial tool when used strategically. It offers the lowest rates for accessing large amounts of home equity, but comes with significant costs and long-term implications. The key is matching the right tool to your specific need:

✅ Consider Cash-Out Refinance When:

You need $30,000+, your current rate is above-market, and you're comfortable with a higher monthly payment and extended loan term. Best for major home improvements, debt consolidation with significant interest savings, or investment in income-producing assets.

⚠️ Consider HELOC Instead When:

You need less than $50,000, want flexibility to draw as needed, or your current mortgage rate is already excellent. HELOCs are ideal for ongoing projects, emergency funds, or situations where you want to preserve your existing favorable mortgage terms.

❌ Avoid When:

You're funding depreciating assets, consumer spending, or speculative investments. Also avoid if you're close to retirement and extending your mortgage will strain cash flow, or if you're already struggling with current payments and the higher amount will worsen your situation.

The most successful borrowers use cash-out refinances as part of a broader financial strategy, not as a reaction to temporary cash flow issues. Run the numbers carefully using our calculator, consider alternatives, and consult with a trusted financial advisor or mortgage professional before making your final decision. Your home is your largest asset—treat it with the strategic respect it deserves.