Understanding your cash on cash return is fundamental to successful real estate investing. This powerful metric reveals how hard your invested cash is working for you, providing a clear picture of your rental property's actual performance. Unlike traditional ROI calculations that factor in property appreciation and equity build-up, cash-on-cash return focuses purely on your annual pre-tax cash flow relative to your initial investment.

Whether you're evaluating your first rental property or analyzing acquisitions for a growing portfolio, this calculator helps professional investors make data-driven decisions. In 2025's dynamic real estate market, where interest rates and property values fluctuate, knowing your exact cash-on-cash return is more critical than ever for maintaining profitability and achieving your investment goals.

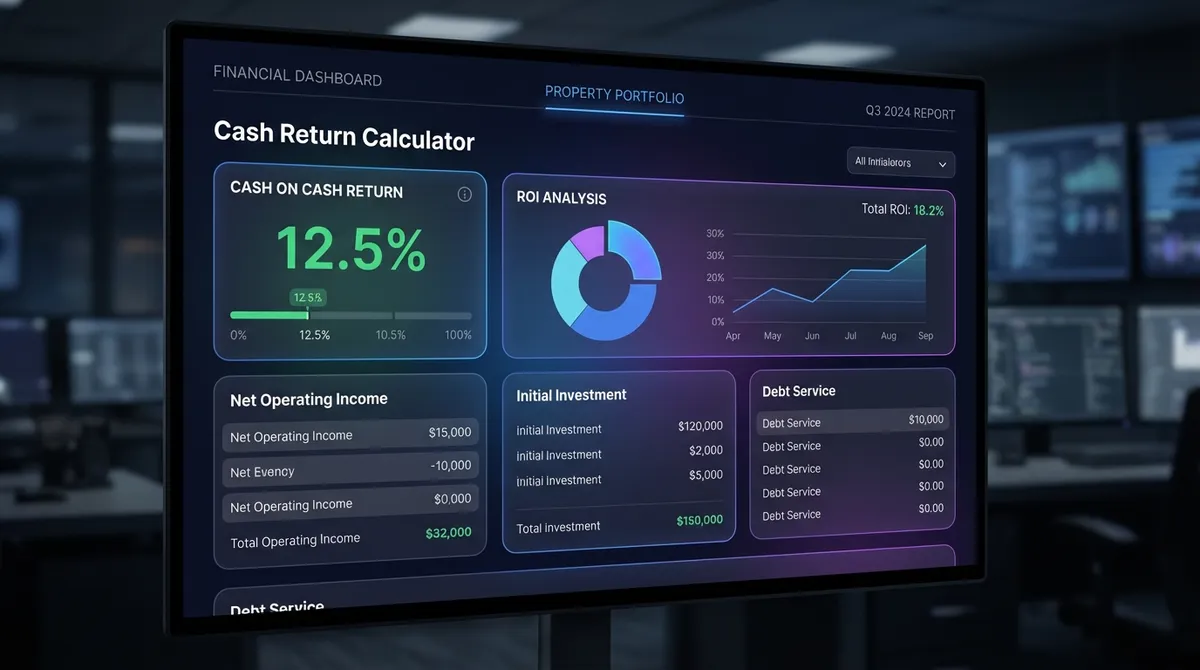

Quick Stats

Cash on Cash Return Calculator

Calculate your real estate investment returns instantly with our professional-grade calculator. Analyze cash flow, ROI, and break-even points for rental properties.

Property Details

Rental Income

Operating Expenses

Financing Details

Investment Results

Industry Benchmarks

Quick Examples

How Cash on Cash Return Calculations Work

The Formula

Cash on Cash Return = (Annual Pre-Tax Cash Flow ÷ Total Cash Invested) × 100This simple yet powerful formula provides investors with a percentage that represents their annual return on invested capital. Unlike complex financial metrics that require advanced calculations, cash-on-cash return offers immediate insight into investment performance.

Breaking Down the Components:

- Annual Pre-Tax Cash Flow: Total rental income minus ALL operating expenses and mortgage payments for the year

- Total Cash Invested: Down payment + closing costs + immediate repairs/improvements

Real-World Example

Purchase Price: $250,000

Down Payment (25%): $62,500

Closing Costs: $5,000

Initial Repairs: $3,000

Total Cash Invested: $70,500

Monthly Rent: $2,800

Annual Expenses: $18,000

Annual Mortgage: $16,200

Cash-on-Cash Return: 11.3%

Professional Applications & Use Cases

Portfolio Diversification

Compare cash-on-cash returns across different property types and markets to build a diversified portfolio. Use the metric to balance high-cash-flow properties with appreciation-focused investments.

Investment Analysis

Professional investors use cash-on-cash return to quickly screen potential acquisitions. Properties below 8% are often eliminated, while those above 12% receive priority consideration.

Risk Assessment

Low cash-on-cash returns may indicate over-leveraging or unrealistic expense projections. Use this metric to identify and mitigate investment risks before committing capital.

Industry Standards for 2025

Professional Investor Benchmarks

Note: These benchmarks assume stable, cash-flow focused investments. High-appreciation markets may have different standards.

Strategic Planning Considerations

Financing Impact

Your financing strategy significantly impacts cash-on-cash return. Higher leverage (lower down payment) can amplify returns when properties perform well, but also increases risk. Consider:

- Interest rates and their impact on monthly cash flow

- Loan terms and amortization schedules

- Private mortgage insurance (PMI) requirements

- Prepayment penalties and refinancing options

Market Factors

Local market conditions heavily influence achievable cash-on-cash returns. Smart investors research:

- Rent-to-price ratios in target neighborhoods

- Property tax rates and assessment practices

- Insurance costs and natural disaster risks

- Local landlord-tenant regulations

Avoiding Common Calculation Pitfalls

Underestimating Expenses

Many investors fail to account for vacancy periods, maintenance reserves, and capital improvements. Always include realistic contingency funds (typically 5-10% of gross rent for maintenance and 5-10% for vacancies).

Overstating Rental Income

Don't use peak market rents when calculating cash-on-cash return. Use conservative, market-average rents to ensure realistic projections. Research comparable properties and factor in seasonal fluctuations.

Ignoring Financing Costs

Cash-on-cash return includes financing costs like mortgage payments, but some investors forget to include loan origination fees, points, and other closing costs in their total investment calculation.

About the Author

Jurica Šinko

Finance Expert, CPA, MBA with 15+ years in corporate finance and investment management

Connect with JuricaCash on Cash Return FAQs

What is a good cash on cash return for rental property?

For 2025, a good cash on cash return typically ranges from 8% to 12%. Returns above 12% are considered excellent, while anything below 8% may indicate a less profitable investment. However, these benchmarks vary by market conditions, property type, and location. In high-appreciation markets, investors might accept lower cash returns expecting equity growth.

How is cash on cash return different from ROI?

Cash on cash return measures your annual pre-tax cash flow relative to your actual cash investment, focusing on immediate income. ROI (Return on Investment) considers your total profit over the entire holding period, including property appreciation, tax benefits, and equity build-up. Cash on cash return is crucial for cash flow planning, while ROI shows your total wealth creation over time. Think of cash-on-cash as your yearly paycheck, while ROI is your lifetime earnings.

What expenses should I include in cash on cash return calculations?

Include all recurring operating expenses: property taxes, insurance, property management fees (typically 8-12% of rent), maintenance reserves (5-10%), vacancy allowance (5-10%), HOA fees, and utilities if paid by owner. Also account for your mortgage principal and interest payments. Initial costs like down payment, closing costs, and immediate repairs should be included in your total cash invested, but not in annual expense calculations.

Why does cash on cash return matter for real estate investors?

Cash on cash return is critical because it shows how much actual cash your investment generates compared to the cash you invested. This metric helps investors: compare different properties objectively, determine if a property generates enough cash flow to cover expenses, plan for portfolio growth using return calculations, and make informed financing decisions. It's particularly important for investors who rely on rental income for living expenses or to fund additional investments.

Can I have a negative cash on cash return?

Yes, negative cash on cash return occurs when your annual expenses exceed your rental income after debt service. This often happens with high mortgage payments, unexpected major repairs, or prolonged vacancies. While negative cash flow isn't ideal, some investors accept it in high-appreciation markets where property value growth outweighs temporary negative cash flow. However, consistently negative returns can strain your finances and limit your ability to acquire additional properties.

How do I improve my cash on cash return?

Improve cash on cash return by: increasing rental income through market-rate adjustments or property improvements, reducing operating expenses by self-managing or negotiating better vendor rates, putting down a larger down payment to reduce mortgage payments (though this reduces leverage benefits), buying properties below market value to increase returns, and targeting markets with favorable rent-to-price ratios. Consider house hacking or short-term rentals to maximize income potential.

Ready to Analyze Your Next Investment?

Use our free cash on cash return calculator to evaluate rental properties with confidence. Make data-driven investment decisions based on real numbers, not guesswork.