What Is Financial Planning and Why Does It Matter in 2025?

Financial planning is the comprehensive process of evaluating your current financial situation, setting measurable goals, and developing strategic actions to achieve those objectives. In 2025, with economic uncertainty, evolving tax laws, and increasing life expectancy, financial planning has become more critical than ever for securing your financial future.

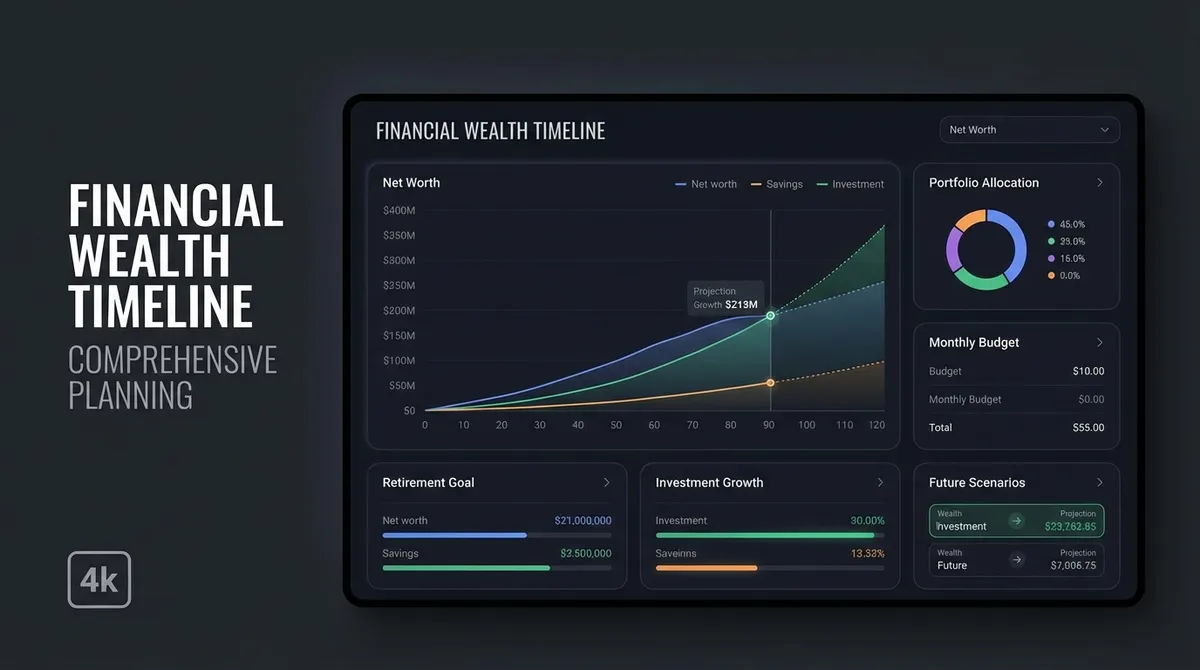

Unlike simple budgeting or basic retirement calculators, true financial planning integrates multiple aspects of your financial life: net worth tracking, cash flow management, debt optimization, investment strategy, risk management, and long-term goal setting. Research shows that people who engage in comprehensive financial planning are 2.7 times more likely to achieve their financial goals and 54% more likely to live comfortably in retirement.

Key Financial Planning Statistics 2025:

- The average American needs $1.8 million in retirement savings to maintain their lifestyle

- Only 32% of Americans have a written financial plan

- Households with financial plans have 3.5 times the net worth of non-planners

How Does Financial Planning Work?

Financial planning operates as a continuous cycle of assessment, goal-setting, implementation, and review. The process begins with gathering comprehensive data about your financial situation—including income, expenses, assets, debts, insurance coverage, and investment portfolios. This foundation allows for accurate projections and scenario modeling.

Modern financial planning leverages advanced algorithms and Monte Carlo simulations to project multiple scenarios based on different assumptions. Unlike static calculators, dynamic financial planning tools adjust projections in real-time as variables change—market returns, inflation rates, life events, or goal adjustments. This creates a living plan that evolves with your circumstances.

The Financial Planning Process:

- 1Assessment: Gather all financial data and documents

- 2Goal Setting: Define short, medium, and long-term objectives

- 3Analysis: Identify gaps and opportunities

- 4Implementation: Execute strategies and monitor progress

- 5Review: Regular updates and adjustments

Core Components Integrated:

- Cash Flow Analysis: Income vs. expenses tracking

- Net Worth Calculation: Assets minus liabilities

- Debt Optimization: Repayment strategies and timelines

- Investment Planning: Portfolio allocation and growth

- Risk Management: Insurance and emergency funds

What Factors Affect Financial Planning Success?

Financial planning success depends on numerous interconnected factors that can significantly impact outcomes. Understanding these variables helps create realistic expectations and robust contingency plans. In 2025, several economic and personal factors have become particularly influential.

Economic Factors

- • Inflation Rate: Affects purchasing power and return requirements

- • Market Volatility: Impacts investment growth projections

- • Interest Rates: Influences debt costs and savings returns

- • Tax Policy Changes: Alters retirement and investment strategies

Personal Circumstances

- • Life Expectancy: Determines retirement savings duration needs

- • Health Status: Impacts healthcare costs and retirement timing

- • Career Stability: Affects income consistency and growth

- • Family Changes: Marriage, children, divorce alter financial needs

Behavioral Factors

- • Discipline: Consistency in saving and investing

- • Risk Tolerance: Ability to withstand market fluctuations

- • Financial Literacy: Understanding of financial concepts

- • Emotional Decision-Making: Avoiding panic during downturns

2025-Specific Considerations:

With the current economic landscape in 2025, financial planners must account for higher interest rates (averaging 5.5-7% for mortgages), increased market volatility due to global uncertainties, evolving tax regulations including potential changes to retirement account rules, and inflation that's averaging 3-4% annually. These factors require more conservative assumptions and robust contingency planning than in previous years.

Common Financial Planning Mistakes to Avoid

Mistake #1: Underestimating Healthcare Costs

Many planners assume Medicare will cover all healthcare expenses in retirement. In reality, the average 65-year-old couple will need approximately $315,000 to cover medical expenses throughout retirement, including premiums, deductibles, and uncovered services.

Solution: Budget $15,000-20,000 annually for healthcare in retirement and consider long-term care insurance.

Mistake #2: Ignoring Inflation Impact

Using today's dollars to calculate future needs without accounting for inflation can leave you significantly short. At 3% annual inflation, prices double every 24 years, meaning $50,000 in expenses today will cost $100,000 in 24 years.

Solution: Always use inflation-adjusted projections and assume 3-4% annual inflation in calculations.

Mistake #3: Failing to Diversify Income Streams

Relying solely on a single income source or traditional retirement accounts creates vulnerability. Job loss, market downturns, or industry changes can devastate an undiversified financial plan.

Solution: Develop multiple income streams including side businesses, rental income, dividends, and passive income sources.

Mistake #4: Not Accounting for Tax Changes

Tax laws change frequently, dramatically altering the effectiveness of certain strategies. Relying on current tax rates for 30-year projections is unrealistic and potentially dangerous.

Solution: Model multiple tax scenarios and maintain flexibility through Roth conversions and tax-diversified accounts.

Mistake #5: Setting It and Forgetting It

Creating a financial plan but never reviewing or adjusting it renders it useless within 2-3 years. Life changes, market conditions evolve, and goals shift—your plan must adapt accordingly.

Solution: Schedule quarterly reviews and comprehensive annual updates to your financial plan.

Financial Planning Strategies for Different Life Stages

Financial planning isn't one-size-fits-all. Your strategy should evolve based on your age, income, family situation, and goals. Here are stage-specific approaches that maximize your financial potential at every life phase.

Ages 20-35: Foundation Building

Priority 1: Emergency Fund

Build 3-6 months of expenses in high-yield savings. Use our emergency fund calculator. Target: $15,000-25,000

Priority 2: Debt Elimination

Attack high-interest debt aggressively. Use avalanche method for maximum efficiency

Priority 3: Retirement Foundation

Start with 10-15% of income in 401(k), capture full employer match

Priority 4: Skill Investment

Invest in education and certifications to increase earning potential

Key Metric: Save 20% of income

Time advantage is your greatest asset

Ages 35-50: Wealth Accumulation

Priority 1: Accelerate Retirement

Max out 401(k), IRA, and consider taxable investment accounts

Priority 2: Diversify Investments

Add real estate, taxable accounts, and alternative investments

Priority 3: College Planning

Start 529 plans for children—target $300-500/month per child

Priority 4: Tax Optimization

Consider Roth conversions, tax-loss harvesting, and HSA maximization

Key Metric: Net worth 3-5x income

Peak earning years require aggressive saving

Ages 50-65: Pre-Retirement

Priority 1: Catch-Up Contributions

Maximize 401(k) catch-up ($7,500 extra) and IRA catch-up ($1,000 extra)

Priority 2: Healthcare Planning

Research Medicare options and consider long-term care insurance

Priority 3: Debt Elimination

Pay off mortgage and all consumer debt before retirement

Priority 4: Social Security Strategy

Plan optimal claiming age (70 for maximum benefits)

Key Metric: Net worth 8-10x income

Shift from growth to preservation

How to Optimize Your Financial Plan for Maximum Results

Optimization transforms a good financial plan into an exceptional one. By implementing advanced strategies and regularly fine-tuning your approach, you can accelerate goal achievement and minimize risk. The following optimization techniques are based on proven methods used by financial advisors for high-net-worth clients.

Tax Optimization Strategies

Tax efficiency can add 1-2% annually to your returns. Implement Roth conversion ladders during low-income years, harvest tax losses in taxable accounts, and maximize HSA contributions (triple tax advantage). Consider asset location— place tax-inefficient investments (bonds) in tax-advantaged accounts and tax-efficient assets (index funds) in taxable accounts.

Expected Impact: 15-25% increase in after-tax wealth over 30 years

Investment Efficiency Optimization

Minimize investment fees by using low-cost index funds (expense ratios under 0.10%). Implement a systematic investment plan (dollar-cost averaging) during accumulation phase, then switch to bucket strategy in retirement. Rebalance annually to maintain target allocation and reduce risk drift.

Expected Impact: 20-30% more wealth vs. high-fee active management

Debt Optimization Sequence

Prioritize high-interest debt (credit cards, personal loans) first, then tackle moderate-interest debt (auto loans, student loans). Keep low-interest mortgage debt if interest rate is below expected investment returns. Consider debt consolidation for multiple high-interest debts to reduce interest rates and simplify payments.

Expected Impact: Save $10,000-50,000 in interest payments

Risk Management Optimization

Maintain appropriate insurance coverage (term life, disability, umbrella) to protect against catastrophic losses. Keep 6-12 months of expenses in liquid emergency funds. Diversify across asset classes, sectors, and geographies. Consider sequence of returns risk in retirement planning.

Expected Impact: Prevent 50-100% wealth destruction from black swan events

Real-World Example: The Smith Family Financial Plan

Scenario: Dual-Income Household Ages 38 and 36

Starting Position (2025)

- • Combined Income: $145,000/year

- • Retirement Savings: $85,000

- • Emergency Fund: $8,000 (2 months)

- • Debt: $22,000 (student loans, car)

- • Home Equity: $65,000

- • Monthly Investment: $800

Optimized Plan Implementation

- • Increased 401(k) contributions to 12% (full match)

- • Opened Roth IRAs for both spouses: $500/month

- • Established HSA and maxed contributions

- • Implemented debt avalanche: $1,200/month

- • Built emergency fund to 6 months: $20,000

Results After 5 Years (2030):

The Smiths are now on track to retire at 62 with $1.8 million in savings, representing a 471% improvement over their original trajectory. Key success factors: increased savings rate from 6.6% to 18.5%, eliminated $22,000 in debt freeing up $1,200/month, and optimized tax strategy saving $3,500 annually.

Key Takeaways: Your Financial Planning Roadmap

Financial planning is the cornerstone of financial success in 2025 and beyond. By taking a comprehensive, integrated approach to managing your finances, you can achieve goals faster, reduce risk, and build wealth more efficiently than through piecemeal strategies.

Next Steps to Implement:

- 1Use the calculator above to assess your current financial position

- 2Set specific, measurable financial goals with target dates

- 3Implement scenario planning to prepare for multiple outcomes

- 4Schedule quarterly progress reviews and annual plan updates

- 5Consider consulting a fee-only financial advisor for complex situations

Remember This:

- Start where you are—perfection isn't required

- Small, consistent improvements compound dramatically

- Flexibility is more valuable than precision

- Behavior beats math—consistency wins

- The best time to start was yesterday; the second best is today

Your financial plan is a living document. The strategies and calculations provided here should be reviewed and adjusted regularly as your life circumstances change. Financial planning is not about perfection—it's about progress, adaptability, and making intentional decisions that align with your values and goals.