What Is Future Value of Annuity and Why It's Critical for Financial Planning in 2025?

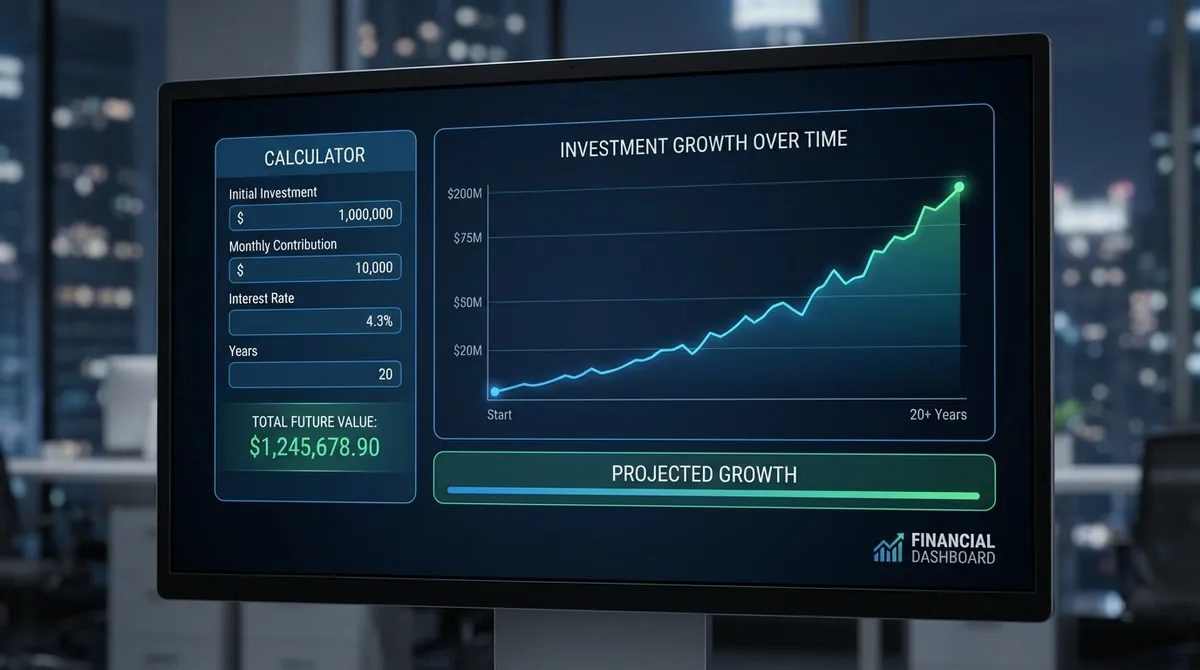

Future Value of Annuity (FVA) is a fundamental time value of money concept that calculates how much a series of equal periodic payments will be worth at a specific future date, given a particular interest rate and compounding frequency. Unlike simple compound interest calculations that assume a single lump sum investment, annuity calculations account for regular contributions over time—making them essential for retirement planning, loan amortization, lease agreements, and any financial scenario involving systematic payments or receipts.

In 2025, with inflation remaining a key economic concern and interest rates at their highest levels in over a decade, understanding FVA has never been more critical for making informed financial decisions. Whether you're planning for retirement, saving for your child's education, evaluating structured settlements, or analyzing investment opportunities, the future value of annuity calculation provides the mathematical foundation for projecting long-term financial outcomes with precision and confidence.

Key Insight: A 30-year-old contributing $500 monthly to a retirement account earning 8% annually will accumulate $1,397,414 by age 65. The total contributions? Only $210,000. The remaining $1,187,414 represents the immense power of compound interest applied to a series of regular payments—the essence of what future value of annuity calculations reveal.

How Future Value of Annuity Calculations Work: Two Essential Formulas

The future value of annuity calculation differs depending on when payments occur during each period. The distinction between ordinary annuity and annuity due significantly impacts your final results, with annuity due always yielding a slightly higher future value due to earlier payment timing.

Ordinary Annuity Formula

Payments occur at the end of each period (typical for retirement accounts, mortgage payments, and most loans)

Annuity Due Formula

Payments occur at the beginning of each period (common for rent, insurance premiums, and some investment accounts)

Variable Definitions:

- •FV (Future Value): The total value of all payments plus accumulated interest at the end of the specified time period

- •PMT (Payment Amount): The consistent periodic payment made or received each period (must remain constant)

- r (Periodic Interest Rate): Annual interest rate divided by number of compounding periods per year (e.g., 8% annual = 0.08/12 monthly)

- •n (Total Number of Periods): Years multiplied by compounding frequency (e.g., 20 years × 12 months = 240 periods)

Critical Distinction: Annuity due provides one extra period of compounding for each payment. On a 20-year, $500 monthly annuity at 8%, annuity due yields approximately $28,000 more than ordinary annuity—demonstrating why payment timing matters significantly in financial planning.

Real-World Example: Maria's 25-Year Retirement Annuity Journey

Meet Maria, a 35-year-old marketing executive who decides to maximize her retirement savings through systematic monthly contributions. She starts with a $25,000 rollover from a previous employer's 401(k) and commits to contributing $750 monthly to a diversified investment portfolio averaging 8.5% annual returns. She uses an ordinary annuity structure (payments at month-end) common to most retirement accounts.

Initial Setup

Starting Balance: $25,000

Monthly Payment: $750

Annual Rate: 8.5%

Duration: 25 years

Frequency: Monthly (12/year)

Annuity Type: Ordinary (end-of-month)

Final Results at Age 60

Total Payments: $250,000

Total Contributions: $275,000

Interest Earned: $985,847

Future Value: $1,260,847

Return Multiple: 4.6x contributions

Millionaire Status: Achieved at age 58

The remarkable aspect of Maria's journey is how compound interest accelerates dramatically over time. In the first 5 years, her account grows to $101,000—primarily from her own contributions. By year 15, it reaches $408,000 as compound interest begins contributing meaningfully. In the final decade, her account explodes to $1.26 million, with the last 5 years alone generating $445,000 in growth—more than the entire first 15 years combined. This demonstrates why time is the most powerful variable in future value of annuity calculations, and why starting early consistently beats trying to catch up later.

💡 Expert Tips from Jurica Šinko to Maximize Future Value of Annuity

1. Start Early, Even With Small Amounts

A 25-year-old investing $300 monthly at 8% reaches $1.57 million by age 65. A 35-year-old must invest $700 monthly for the same result—2.3x more! The first 10 years of compounding are the most valuable. Even $100/month in your 20s is more powerful than $500/month in your 40s.

2. Optimize Payment Timing When Possible

If you have a choice, always opt for annuity due (beginning-of-period payments). On a $500 monthly annuity at 7% over 30 years, annuity due yields $28,450 more than ordinary annuity—that's a free 5% bonus just from payment timing. Many investment platforms allow you to choose payment dates.

3. Increase Payments Systematically

Boost your payment by 3% annually (just $15 more on a $500 payment). This leverages both compound interest and compound contributions. Over 30 years at 8%, this strategy adds $312,000 compared to static payments—a 25% improvement with minimal lifestyle impact.

4. Maximize Compounding Frequency

Daily compounding beats annual compounding. On $10,000 at 8% over 30 years, daily compounding adds $7,200 compared to annual. Always choose accounts that compound most frequently—this free boost adds up significantly over decades.

5. Front-Load When Possible

Starting with a lump sum dramatically increases final value. Adding $25,000 initially to your annuity at age 30 adds $367,000 to your final balance at age 65—a 14.7x multiplier. Consider rolling over old 401(k)s or using bonuses to jumpstart your annuity.

⚠️ Critical Mistakes That Destroy Future Value of Annuity Wealth

Mistake 1: Delaying Contributions Even Briefly

Postponing your annuity by just 5 years (starting at 35 instead of 30) requires 52% higher monthly payments to reach the same goal. The cost of waiting isn't linear—it's exponential. Start with whatever you can afford today, even if it's just $50/month.

Mistake 2: Underestimating Required Payments

Using overly optimistic return assumptions (12% instead of realistic 7-8%) leads to massive shortfalls. A 45-year-old needing $1 million by age 65 would need $1,850/month at 8% returns, but only $1,100/month at 12%—a $750/month difference that leaves them $400,000 short if returns underperform.

Mistake 3: Withdrawing or Pausing Contributions

Interrupting your annuity for just 2 years reduces your 30-year final balance by 12-15%. A $500/month annuity at 8% reaches $745,000 uninterrupted, but only $635,000 with a 2-year pause—a $110,000 loss from just 24 missed payments.

Mistake 4: Ignoring Inflation in Planning

$1 million in 30 years is worth only $412,000 in today's dollars at 3% inflation. Always calculate future value in real terms. A $2,000/month annuity might sound sufficient, but with inflation it purchases only $820/month of today's lifestyle.

Mistake 5: High Fees That Compound Against You

A 1% annual fee on your annuity reduces your final balance by 25-30% over 30 years. On a $500,000 annuity, that's $125,000-150,000 lost to fees. Choose low-cost index funds (expense ratios under 0.10%) and avoid actively managed annuities with high fees.

Real-World Applications: When to Use Future Value of Annuity Calculator

Retirement Planning

Calculate how much your 401(k) or IRA contributions will be worth at retirement. Essential for determining if you're on track and how much you need to save monthly to reach your retirement goals.

Education Savings

Project the growth of 529 college savings plans with regular contributions. Determine if current savings rates will cover future tuition costs and adjust accordingly.

House Down Payment

Calculate how long it will take to save for a down payment with regular monthly contributions to a high-yield savings account or investment account.

Insurance & Settlements

Evaluate structured settlements, lottery winnings paid as annuities, or insurance products that provide periodic payments over time.

Investment Analysis

Compare different investment vehicles (CDs, bonds, dividend stocks) that provide regular income streams and calculate their long-term growth potential.

Business Planning

Calculate future value of regular business investments, lease agreements, or equipment financing arrangements with systematic payment structures.