What Is Gross Margin and Why It Matters in 2025

Gross margin is the percentage of revenue that exceeds your Cost of Goods Sold (COGS)—the direct costs of producing or acquiring what you sell. In 2025's competitive business landscape, where supply chain costs fluctuate and consumer price sensitivity remains high, understanding and optimizing your gross margin isn't just accounting—it's survival. A healthy gross margin means you have enough money left over after covering direct costs to pay operating expenses, invest in growth, and generate profit.

Unlike net profit margin that includes all expenses, gross margin isolates the profitability of your core business operations. This makes it one of the most critical metrics for strategic decision-making. Whether you're a startup seeking venture capital, a small business owner planning expansion, or a corporate executive evaluating product lines, gross margin reveals which parts of your business actually make money.

Key Statistic: Industry Benchmarks 2025

The average gross margin varies dramatically by industry: retail typically operates at 20-30%, manufacturing at 35-45%, software/SaaS at 70-85%, and luxury goods at 60-75%. A SaaS company with 75% gross margin has fundamentally different economics than a retailer at 25%—yet both can be healthy within their industry context. The key is knowing your benchmark and continuously improving relative to competitors.

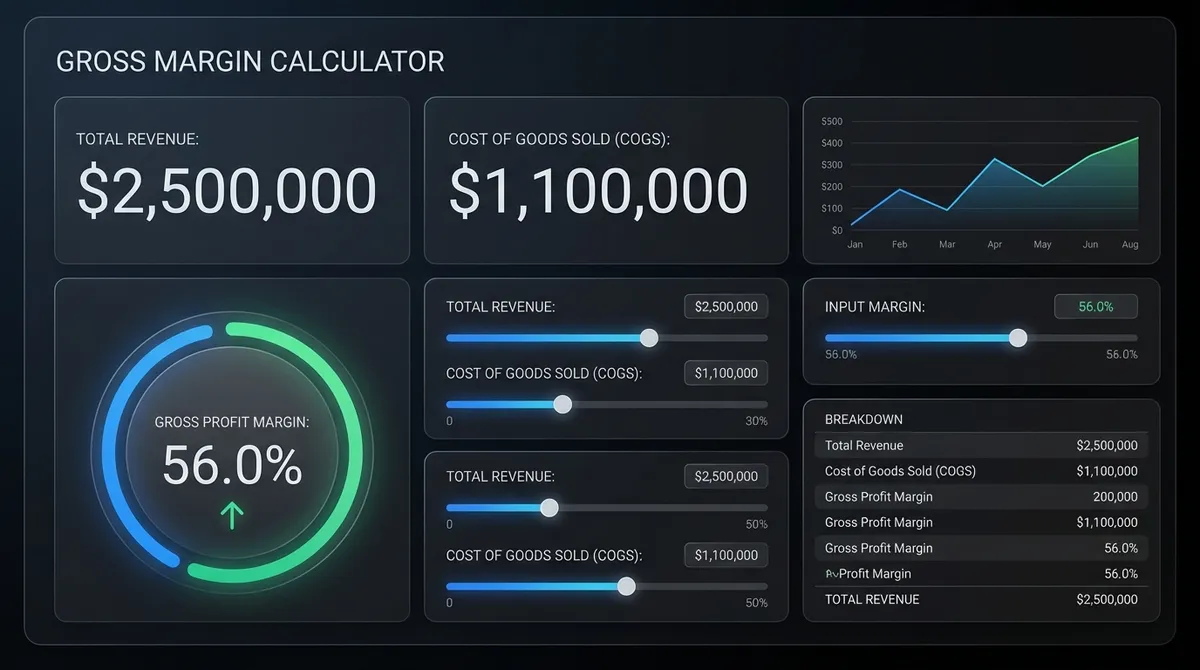

The Gross Margin Formula Demystified

The gross margin formula is deceptively simple, but mastering it requires understanding each component and its business implications. Here's the complete breakdown:

Gross Margin = (Revenue - COGS) ÷ Revenue × 100

or

Gross Margin = Gross Profit ÷ Revenue × 100

Revenue

Total sales or income from goods/services sold. This is your top-line number before any expenses. In accounting, it's called "net sales" after returns and discounts.

COGS

Cost of Goods Sold—direct costs: materials, labor, shipping, packaging. Excludes indirect expenses like marketing, rent, or administrative salaries.

Gross Profit

Revenue minus COGS. This is the money left to cover operating expenses (rent, salaries, marketing) and generate net profit.

The formula reveals a critical insight: gross margin percentage shows what portion of each dollar earned stays with your company. A 40% gross margin means you keep $0.40 from every $1.00 of revenue after covering direct costs. This remaining $0.40 must fund all other business activities and profit.

Common Mistake: Including Indirect Costs

Many business owners incorrectly include rent, marketing, or administrative salaries in COGS. This inflates your true production costs and gives misleading margin data. COGS is ONLY direct costs—materials you can touch, direct labor hours, shipping to customers. Everything else is an operating expense that appears below the gross profit line on your income statement.

Real-World Example: Tech Startup Scaling Challenges

Meet Alex, founder of "EcoTech Gadgets," a startup selling sustainable phone accessories. In 2024, Alex generated $500,000 in revenue but struggled with cash flow despite strong sales. Using our gross margin calculator revealed why:

EcoTech Gadgets 2024 Financials

Total Revenue

$500,000

COGS (Materials, Manufacturing, Shipping)

$380,000

Gross Profit

$120,000

Gross Margin

24%

Alex's 24% gross margin explained the cash flow problem. After paying $120,000 in operating expenses (salaries, rent, marketing, software), the company barely broke even. The calculator's recommendations suggested two paths: negotiate better supplier terms to reduce COGS by 10% (adding $38,000 to gross profit), or reposition products at premium prices to improve margin percentage.

The Break-Even Analysis

With 24% gross margin, EcoTech needed $500,000 ÷ 0.24 = $2,083,333 in revenue just to cover $500,000 in operating expenses. By improving gross margin to 35% through better sourcing and premium pricing, the revenue growth needed to achieve profitability.

Industry Benchmarks: What's a "Good" Gross Margin in 2025?

"Good" gross margin is entirely industry-dependent. A 25% margin is excellent for grocery retail but catastrophic for software. Here's the comprehensive 2025 benchmark data:

Retail & E-commerce

Manufacturing

Services & Technology

How to Use Benchmarks

Always compare your gross margin to direct competitors, not industry averages. If you're a premium brand, benchmark against other premium brands. If you're a discount retailer, compare to other discounters. Your strategic positioning should reflect in your margin structure. A 10% variance from direct competitors signals either competitive advantage or operational inefficiency that needs investigation.

Common Mistakes and How to Avoid Them

Mistake #1: Including Indirect Costs

Problem: Adding rent, marketing, or salaries to COGS artificially deflates your true production margin.

Solution: COGS includes only direct costs. If you can't trace it directly to product creation, it's an operating expense.

Mistake #2: Ignoring Inventory Changes

Problem: Not adjusting for beginning/ending inventory distorts COGS and margins.

Solution: Use the formula: COGS = Beginning Inventory + Purchases - Ending Inventory.

Mistake #3: Confusing Margin with Markup

Problem: 40% markup is NOT 40% margin. Many business owners price incorrectly.

Solution: Remember: Margin % = (Price - Cost) ÷ Price. Markup % = (Price - Cost) ÷ Cost.

Mistake #4: Not Tracking by Product Line

Problem: Company-wide averages hide high/low margin products, leading to poor decisions.

Solution: Calculate gross margin separately for each product/service line to identify winners and losers.

Pro Tip: Monthly Monitoring

Calculate gross margin monthly, not annually. Early detection of margin erosion gives you time to adjust pricing, renegotiate supplier contracts, or optimize operations before small issues become cash flow crises. A 2% monthly margin decline compounds to 24% annually—devastating if caught too late.

Strategies to Improve Your Gross Margin

Reduce COGS Through Supplier Negotiation

Every 5% reduction in COGS directly increases gross margin by several points. Consolidate suppliers for volume discounts, negotiate longer contracts for better rates, or explore alternative materials that maintain quality at lower cost.

Impact: 5% cost reduction on $100K COGS = $5K additional gross profit = 1-3% margin improvement.

Optimize Pricing Strategy

Implement value-based pricing instead of cost-plus. Survey customers to understand willingness-to-pay, test price increases on less price-sensitive segments, or bundle high-margin items with popular products.

Impact: A 10% price increase with 15% volume loss can still improve total gross profit if margin percentage increases.

Streamline Production Efficiency

Reduce waste, improve labor productivity, automate repetitive tasks, or reengineer products for easier manufacturing. Lean manufacturing principles can cut production costs 15-25%.

Impact: 20% efficiency gain on $50K labor costs = $10K annual savings directly to gross profit.

Product Mix Optimization

Shift marketing and sales focus toward higher-margin products. Discontinue low-margin items that consume resources, or reposition them as premium offerings with enhanced features.

Impact: Moving 20% of sales from 20% margin products to 50% margin products can increase overall margin by 3-6 percentage points.

Action Plan: 90-Day Margin Improvement

- Week 1-2: Calculate gross margin by product line using this calculator

- Week 3-4: Identify top 3 margin improvement opportunities

- Month 2: Implement one pricing adjustment and one cost reduction initiative

- Month 3: Measure results and expand successful strategies

Expert Insight: Gross Margin as a Competitive Weapon

Companies with higher gross margins have more strategic options. They can outspend competitors on marketing, invest more in R&D, absorb cost increases during inflation, or drop prices to gain market share while remaining profitable. In 2025's uncertain economic environment, gross margin isn't just a metric—it's your strategic flexibility and competitive moat.

By Jurica Šinko • November 14, 2025