What Is a Home Equity Loan? (The "Second Mortgage" Explained)

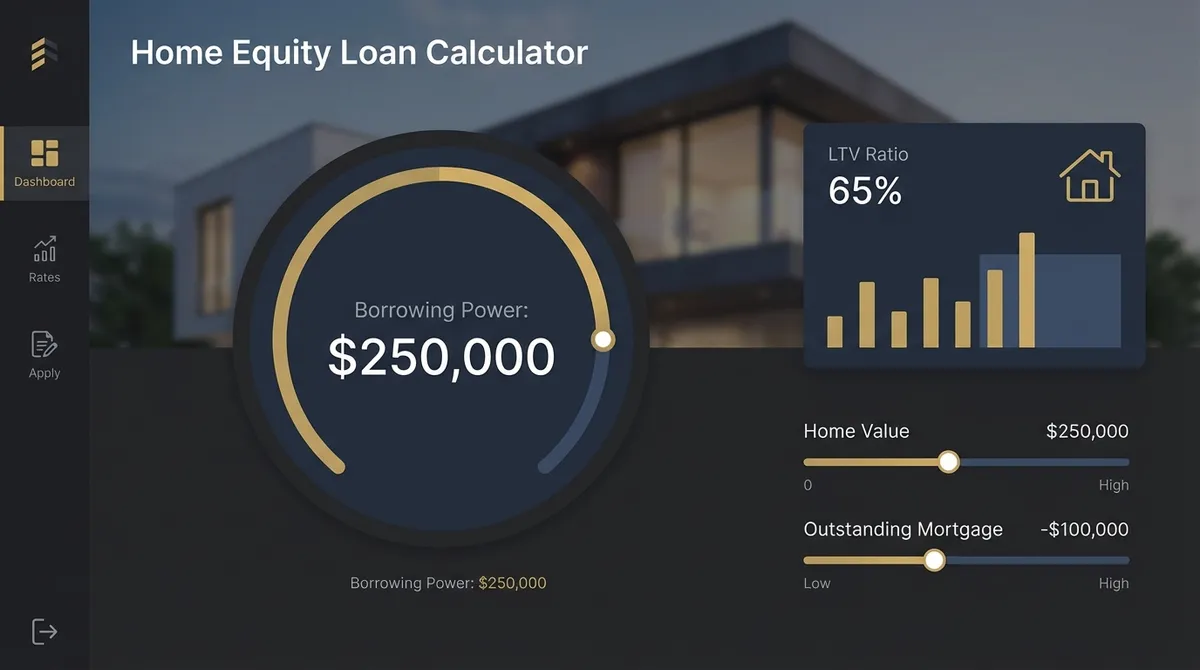

A home equity loan is a lump-sum loan that allows you to borrow against the difference between what your home is worth and what you currently owe on your mortgage. Because your home serves as collateral, interest rates are typically much lower than personal loans or credit cards—often by 5–10 percentage points.

Often called a "second mortgage," a home equity loan provides a one-time cash payout with a fixed interest rate and fixed monthly payments. This makes it ideal for one-time major expenses where you need predictability, such as a kitchen renovation, roof replacement, or debt consolidation.

Home Equity Loan vs. HELOC: What's the Difference?

- Home Equity Loan: Lump sum cash, fixed interest rate, fixed monthly payments. Best for one-time expenses.

- HELOC (Line of Credit): Revolving credit (like a credit card), variable interest rate, draw period followed by repayment. Best for ongoing projects.

How Home Equity Loan Payments Are Calculated

Home equity loans use the standard amortization formula, meaning your monthly payment is mathematically calculated to pay off both the interest and the principal exactly by the end of your term (e.g., 10, 15, or 20 years). The formula is:

The total amount you borrow (e.g., $50,000).

Your annual interest rate divided by 12 (e.g., 9% / 12 = 0.0075).

The number of years times 12 (e.g., 15 years × 12 = 180 months).

The "Front-Loaded Interest" Effect

Like your primary mortgage, a home equity loan is amortized. This means in the early years, a huge chunk of your monthly payment goes toward interest rather than paying down the loan balance. On a 15-year loan, you might not pay off half the principal until year 9 or 10.

Real-World Scenario: The Johnson Family's Kitchen Renovation

Let’s say you need $50,000 to remodel your kitchen and add a bathroom. Here is how financing that with a home equity loan compares to putting it on a credit card.

Home Equity Loan

- Interest Rate8.5% Fixed

- Term15 Years

- Monthly Payment$492

- Total Interest Paid$38,623

Credit Card

- Interest Rate22% Variable

- Term~15 Years (to match payment)

- Monthly Payment$917 (Minimum)

- Total Interest Paid$115,000+

*Interest on home equity loans is typically tax-deductible if the funds are used to buy, build, or substantially improve your home. Consult a tax professional.

4 Critical Mistakes to Avoid

1. Ignoring Closing Costs

Just like your first mortgage, home equity loans come with closing costs (appraisal, origination, recording fees) that often range from 2% to 5% of the loan amount. Always ask for a "no-closing-cost" option to compare calculator results.

2. Borrowing More Than You Need

Because you receive a lump sum, it's tempting to borrow extra "just in case." However, you pay interest on the full amount immediately. Only borrow exactly what your project or debt consolidation requires.

3. Focusing Only on the Monthly Payment

A 30-year term will have a much lower monthly payment than a 10-year term, but you will pay triple the interest over the life of the loan. Use the calculator to see the "Total Interest" field before deciding.

4. Putting Your Home at Risk for Consumer Spending

Never use a home equity loan for vacations, luxury cars, or weddings. If you lose your job and can't make payments, the bank can foreclose on your home. Save equity for wealth-building moves like renovations or high-interest debt elimination.

Home Equity Loan vs. Cash-Out Refinance

Many homeowners confuse these two options. A home equity loan is a second mortgage (you keep your original mortgage). A cash-out refinance replaces your original mortgage with a new, larger one.

| Feature | Home Equity Loan | Cash-Out Refinance |

|---|---|---|

| Interest Rate | Higher (Second lien risk) | Lower (First lien security) |

| Closing Costs | Lower (2-5% of loan amount) | Higher (2-5% of total mortgage) |

| Best When... | You have a great rate on your primary mortgage (e.g., 3%) that you don't want to lose. | Current market rates are lower than your existing mortgage rate. |

How Credit Score Impacts Your Rate

Your credit score is the single biggest factor in determining your interest rate. A difference of 50 points can save—or cost—you thousands.

*Rates are illustrative. Lenders also consider Debt-to-Income (DTI) and Loan-to-Value (LTV) ratios.

Application Checklist: Documents You Need

To get approved quickly (and lock in a rate before it rises), have these documents ready before you apply:

- W-2 forms (last 2 years)

- Pay stubs (last 30 days)

- Mortgage statement (current loan)

- Homeowners insurance policy

- Property tax bill (latest)

- Bank statements (last 2 months)

Inflation's Hidden Impact on Your Equity

Inflation is often seen as the enemy of your wallet, but it can be the best friend of your home equity. As inflation drives up the cost of labor and materials, the replacement cost of your home rises, often pulling its market value up with it.

The "Inflation Hedge" Effect

If you have a fixed-rate mortgage, your "housing cost" stays the same while the value of the asset (your home) increases. This widens the gap between what you owe and what you own—creating more equity without you lifting a finger. A home equity loan allows you to tap into this inflation-created wealth.

Debt Consolidation Strategy: The Math Behind the Move

The most popular use for home equity loans in 2025 is consolidating high-interest credit card debt. Here is why the math works so well:

| Scenario | Debt Amount | Avg. Rate | Monthly Cost |

|---|---|---|---|

| Before (Credit Cards) | $30,000 | 24% | $750 (Interest Only) |

| After (Home Equity Loan) | $30,000 | 9% | $380 (Princ + Int) |

Warning: This strategy only works if you stop using the credit cards. If you pay them off with your house but run the balances back up, you put yourself in a double-debt trap.

How to Shop for the Best Lender

Don't just go to your current bank. Loyalty rarely pays in lending. Rates can vary by 1-2% between lenders, which equals thousands of dollars over the loan term. According to the CFPB, shopping around is the best way to get a good deal.

Credit Unions

Often have the lowest rates because they are non-profits. However, their technology might be outdated and approval times slower.

Online Lenders

Fast digital applications and competitive rates. Great for speed, but customer service can be impersonal.

Big Banks

Convenient if you already bank there (sometimes offer rate discounts). Typically have stricter underwriting standards.

The Secret Weapon

Get a "Loan Estimate" from one lender and show it to another. Lenders will often match or beat a competitor's offer to win your business.

Expert Tip: How to Save Thousands

You don't have to stick to the bank's schedule. By making just one extra payment per year (or rounding up your monthly payment), you can slash years off your loan term.

The "Round Up" Strategy

If your payment is $492/month, consider paying $550/month. That extra $58 goes 100% toward principal. On a $50k loan, this small change could save you over $5,000 in interest and pay off the loan 2.5 years early.

About the Author

Jurica Šinko is a seasoned finance expert specializing in mortgage lending and residential real estate strategy. With over 15 years of experience, he helps homeowners make data-driven decisions about their equity.

Last updated: September 12, 2025