What Is Inflation? A Simple Guide for 2025

Inflation is the silent force that shrinks your wallet without taking a single dollar. It measures how much prices range rise over time, and consequently, how the purchasing power of your money falls. When inflation is high, your $100 bill buys fewer groceries, less gas, and covers less rent than it did a year ago.

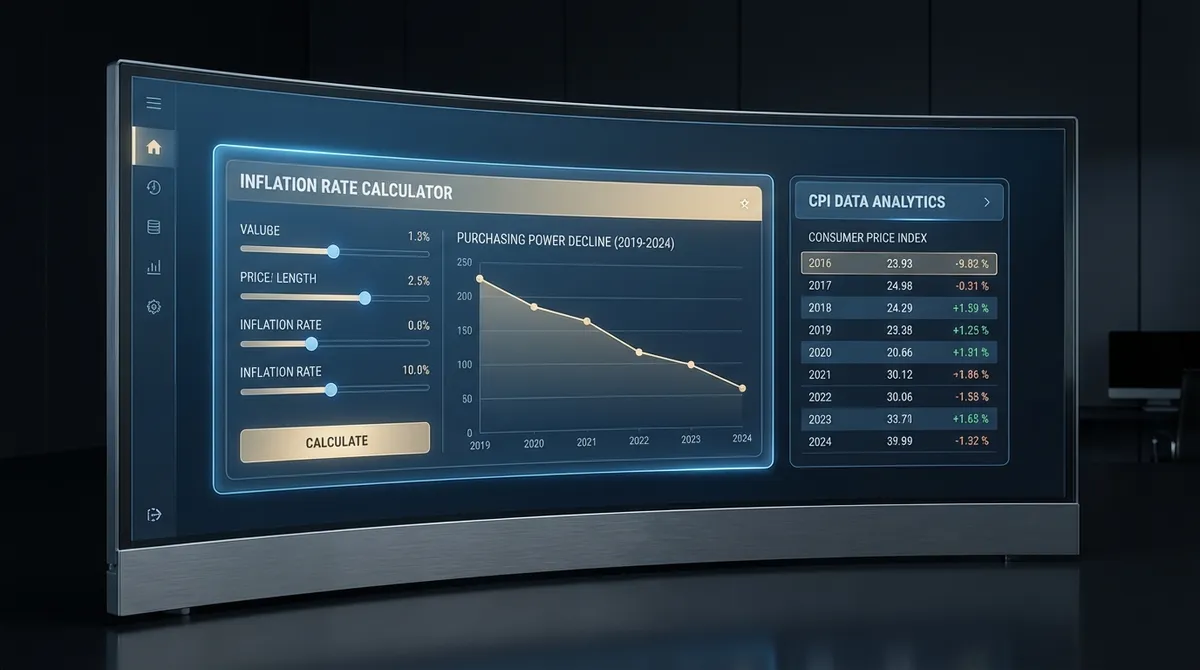

In 2025, understanding inflation isn't just for economists—it's essential for anyone managing a budget, negotiating a salary, or planning for retirement. By tracking the Consumer Price Index (CPI), you can measure exactly how much value your money has lost and what you need to earn to stay ahead.

Why It Matters

If inflation averages just 3% per year (its historical norm), the value of your savings will be cut in half in about 24 years. This means a $1 million retirement fund today would only buy $500,000 worth of goods in the future.

How to Calculate Inflation Rate

The standard way to calculate inflation is by comparing the Consumer Price Index (CPI) between two periods. The formula is simple:

The Variables

- 1Initial CPI:

The price index at the start of your period (e.g., the year you bought a house).

- 2Target CPI:

The price index at the end of your period (e.g., today or a future projection).

Real World Example

Calculating inflation from 2020 to 2024:

- CPI (Jan 2020):258.8

- CPI (Jan 2024):308.4

- Total Inflation:19.16%

*This means a basket of goods costing $100 in 2020 would cost ~$119.16 in 2024.

Historical Inflation Context

Inflation varies wildly depending on economic conditions. Here is a snapshot of historical U.S. inflation eras to help contextualize your results:

Peaked at ~14.8% in 1980 due to oil shocks.

Averaged ~2-3%, considered healthy for growth.

Spiked to ~9.1% (June 2022) before cooling.

3 Ways to Protect Your Wealth

Invest in Equities (Stocks)

Historically, the stock market (S&P 500) returns ~10% annually, which is well above the average 3% inflation rate. Companies can raise prices during inflationary periods, protecting their profits and your returns. A high ROI is crucial during these times.

TIPS (Treasury Inflation-Protected Securities)

These are government bonds specifically designed to fight inflation. The principal value of TIPS rises with inflation (measured by CPI), guaranteeing your real purchasing power is preserved.

Real Assets

Real estate and commodities (like gold) often hold their value or appreciate when currency loses value. They serve as a physical hedge against the eroding power of the dollar.

The Economics Behind the Numbers

Inflation doesn't just happen; it is driven by specific economic forces. Economists generally sort these into two buckets:

1. Demand-Pull Inflation

"Too much money chasing too few goods." When consumer demand outpaces supply, prices rise. This often happens when the economy is booming or when the government injects stimulus money into the system.

2. Cost-Push Inflation

When the cost of production rises (e.g., oil prices spike or wages increase), companies pass those costs to consumers. This is often more damaging because it can occur even when the economy is slowing (stagflation).

Hyperinflation vs. Deflation vs. Disinflation

It's easy to get these terms mixed up, but they mean very different things for your wallet:

Out-of-control inflation (usually >50% per month). Think Zimbabwe or Venezuela. Currency becomes worthless rapidly.

When prices fall below 0%. While cheap goods sound great, deflation often signals a deep recession (like the Great Depression) because businesses cut wages and jobs.

A slowdown in the rate of inflation. If inflation goes from 8% to 4%, prices are still rising, but slower. This is usually the goal of the Federal Reserve.

The Federal Reserve's Tool: Interest Rates

The Federal Reserve has a "dual mandate": maximize employment and keep prices stable. Their main weapon against inflation is the Federal Funds Rate.

The Cycle of Rate Hikes

*This is why mortgage rates and credit card APRs skyrocket when the Fed tries to fight inflation.

The Rule of 72: When Will Your Money Lose Half Its Value?

A quick mental math trick to understand inflation's impact is the Rule of 72. While traditionally used to calculate investment doubling time, it works in reverse for inflation halving time.

The Formula

72 ÷ Inflation Rate = Years to Halve Purchasing Power

This demonstrates why even "low" inflation is dangerous over a standard 30-year retirement. Strategies that strictly hold cash will guarantee a loss of purchasing power.

Your "Personal Inflation Rate" Matters More

The CPI is a national average. Your personal inflation rate might be totally different depending on your lifestyle.

- CommutersIf you drive 50 miles a day, a spike in gas prices hurts you 5x more than a remote worker.

- RentersRenters face annual lease hikes. Homeowners with fixed-rate mortgages are immune to housing inflation (their payment is locked).

- ParentsChildcare and education costs consistently rise faster than general inflation.

- Vegans vs. Meat EatersMeat prices are volatile due to feed costs. Produce prices fluctuate with weather. Your grocery cart dictates your inflation.

5 Actionable Steps to Beat Inflation in 2025

You cannot control the Federal Reserve, but you can control your household economy. Here is a tactical checklist to preserve your wealth:

Negotiate Your Salary

If inflation is 4% and you get a 2% raise, you effectively took a pay cut. Use CPI data to justify a cost-of-living adjustment (COLA) during your annual review or use a salary inflation calculator to see your real wage.

Lock in Fixed-Rate Debt

Inflation benefits borrowers with fixed rates. Keep your 30-year mortgage. Avoid variable-rate credit cards or HELOCs, as their rates will rise with inflation.

Delay Big Ticket Purchases

During high inflation, supply chains often snarl (raising prices). If you can wait 6-12 months for that new car or kitchen remodel, prices often normalize as demand cools.

Review Subscriptions

"Skimpflation" is real—services reduce quality while keeping prices same. Audit your recurring expenses. Are you getting the same value from streaming or software subscriptions as you did last year?

Diversify Income Streams

Relying on one paycheck makes you vulnerable. Side hustles, dividend stocks, or rental income provide a buffer when prices spike unpredictably.

Frequently Asked Questions

Is 0% inflation the goal?

Actually, no. Central banks usually target 2% inflation. A little inflation encourages spending (because money will be worth less later) and investment. 0% inflation or deflation can stall the economy because people hoard cash waiting for lower prices.

Does gold really beat inflation?

Over very long periods (centuries), yes. But in the short term, gold is volatile. For example, in the high inflation of 1980, gold peaked and then crashed, taking 28 years to recover. Stocks and real estate have historically been more consistent inflation hedges for most investors.

What is "Shrinkflation"?

Shrinkflation is a sneaky form of inflation where the price stays the same, but the product gets smaller. You pay $4.99 for a bag of chips, but the bag goes from 16oz to 14oz. Since CPI tracks the price per unit, it tries to capture this, but consumers often miss it until they check the fine print.

How do I find the current CPI?

The U.S. Bureau of Labor Statistics (BLS) releases the CPI data monthly, typically around the 12th. You can view the latest reports on their website (bls.gov) to get the official numbers for calculating inflation precisely.