What Is Retirement Age Planning and Why It Matters in 2025?

Key Statistics

64

Years old

10-12x

Your annual salary

18-20

Years in retirement

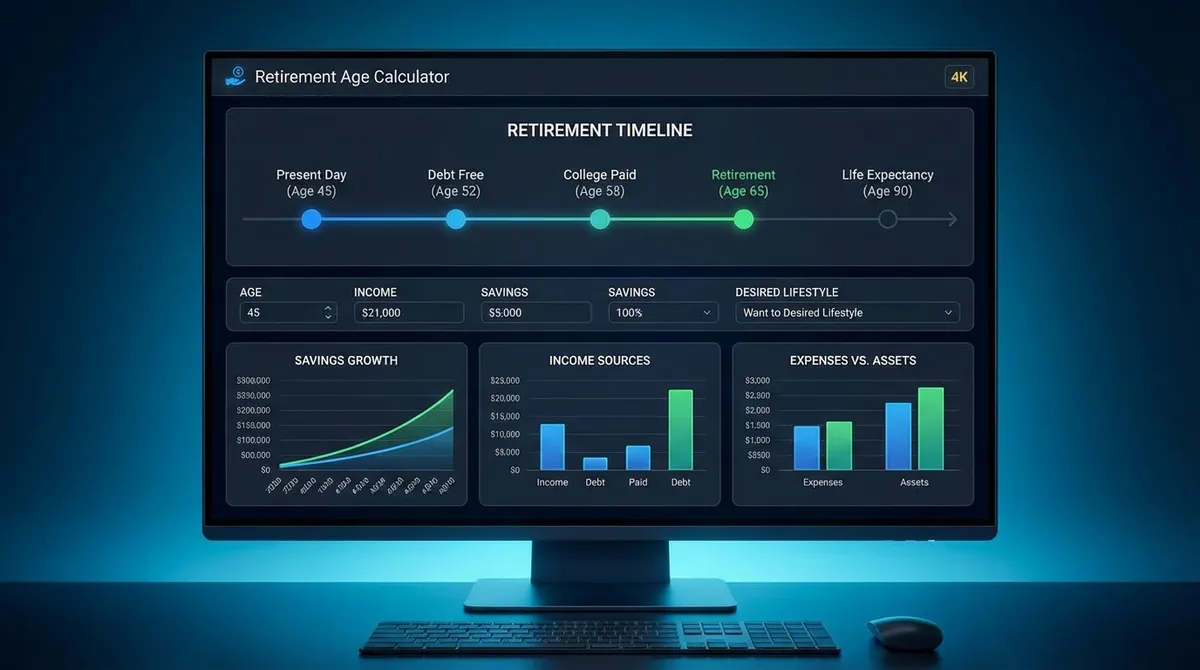

Retirement age planning is the strategic process of determining when you can afford to stop working based on your current financial situation, savings rate, investment returns, and desired lifestyle. Unlike traditional retirement planning that focuses on how much to save, retirement age planning answers the critical question: "When can I actually retire?"

In 2025, with increased life expectancy, rising healthcare costs, and uncertainty around Social Security benefits, understanding your personal retirement age has never been more crucial. The average American now lives 18-20 years after retirement age, making it essential to plan for a financially secure and comfortable retirement that could last two decades or more. Check the official Social Security retirement age to see how it affects your benefits.

Whether you're just starting your career in your 20s, building wealth in your 40s, or approaching retirement in your 60s, knowing your target retirement age helps you make informed decisions about savings rates, investment strategies, and lifestyle adjustments. This calculator helps you model different scenarios so you can align your financial habits with your retirement goals.

The Mathematics Behind Retirement Age Calculations

Our retirement age calculator uses sophisticated financial mathematics to determine when you can retire based on compound growth and systematic contributions. Understanding these calculations helps you make informed decisions about your financial future.

Key Variables Explained

- •FV (Future Value): Your retirement target amount

- •PV (Present Value): Current retirement savings

- •PMT: Monthly contribution amount

- •r: Monthly interest rate (annual return ÷ 12)

- •n: Number of months until retirement

Calculation Process

- 1Determine monthly return rate from annual expected return

- 2Solve the equation for n using logarithmic functions

- 3Convert months to years and add to current age

- 4Generate yearly breakdown showing growth trajectory

Important Note

The calculation assumes consistent monthly contributions and constant returns. In reality, investment returns fluctuate, and contribution amounts may change over time. This calculator provides a realistic estimate based on average assumptions.

Meet Sarah: From $50K to $1 Million

Sarah is a 30-year-old marketing manager who wants to retire early at age 60 with $1 million in savings. She currently has $50,000 saved and can contribute $1,200 per month. Using our calculator, let's see if her plan works and what adjustments she might need to make.

Starting Position (Age 30)

- ✓Current Savings: $50,000

- ✓Monthly Contribution: $1,200

- ✓Expected Return: 7% annually

- ✓Target Amount: $1,000,000

Results at Age 56.5

- ✓Retirement Age: 56.5 years

- ✓Total Contributions: $431,600

- ✓Investment Gains: $568,400

- ✓Final Balance: $1,000,000

Sarah's 26.5-Year Journey

Key Insights from Sarah's Case

- →Starting Early Pays Off: Sarah reaches her goal 3.5 years ahead of schedule

- →Compound Interest Dominates: 71% of final balance comes from investment gains

- →Consistency is Key: $1,200 monthly for 26.5 years creates $1M

- →Reasonable Returns: 7% average return is achievable with diversified portfolio

What Factors Affect Your Retirement Age?

Your retirement age is influenced by multiple interconnected factors. Understanding how each factor impacts your timeline helps you make strategic adjustments to reach your goals faster.

Savings Rate

Higher monthly contributions accelerate your timeline significantly

Investment Returns

Small increases in returns compound dramatically over time

Starting Amount

Initial savings jump-starts your compound growth journey

Retirement Goal

Higher target amounts require more time or higher savings

Detailed Impact Analysis

Monthly Contribution Impact

Increasing your monthly contribution by just $200 can reduce your retirement age by 3-5 years, depending on your current savings and target amount. For example, saving $1,000/month instead of $800/month could help you retire 4 years earlier with the same target amount.

Investment Return Impact

A 1% increase in annual returns (from 6% to 7%) can reduce your retirement age by 2-4 years. Over 30 years, this small difference can result in hundreds of thousands of additional dollars due to compound interest working in your favor.

Starting Age Impact

Starting to save at age 25 instead of 35 can reduce your retirement age by 5-8 years when targeting the same amount. The extra 10 years of compound growth means you need to save 30-40% less per month to reach the same goal.

Inflation Consideration

At 3% average inflation, $1 million today will have the purchasing power of approximately $400,000 in 30 years. This means you may need to target 2.5x your current retirement goal to maintain the same lifestyle in the future.

Common Retirement Age Planning Mistakes to Avoid

Many people make critical errors when planning their retirement age, often leading to delayed retirement or insufficient savings. Avoid these common pitfalls to stay on track with your goals.

Underestimating Healthcare Costs

A 65-year-old couple retiring in 2025 needs approximately $315,000 for healthcare expenses throughout retirement. Many people target their retirement goal without including these costs, potentially falling short by 15-25%.

Ignoring Inflation Impact

Targeting $1 million for retirement in 30 years without inflation adjustment means you'll only have the purchasing power of $400,000-$500,000 in today's dollars. This mistake can delay your effective retirement by 8-10 years.

Overly Optimistic Return Assumptions

Assuming 10-12% annual returns consistently is unrealistic. Market volatility means actual returns vary significantly. Using these high assumptions can make you think you can retire 5-7 years earlier than realistically possible.

Not Accounting for Market Downturns

Retiring during a market downturn can permanently reduce your portfolio's sustainability. Sequence of returns risk means early negative returns in retirement can deplete your savings 30% faster than expected.

How to Optimize Your Retirement Age

There are several proven strategies to accelerate your retirement timeline. Implementing even 2-3 of these strategies can help you retire 3-7 years earlier than your current projection.

Increase Savings Rate Early

Boost your savings rate by 5-10% in your 20s and 30s. Every dollar saved in your 20s is worth $7-10 in your 60s due to compound interest.

Optimize Investment Allocation

Use tax-advantaged accounts (401k, IRA, Roth IRA) and maintain an age-appropriate stock/bond allocation to maximize returns.

Pay Off Mortgage Early

Eliminating mortgage payments before retirement reduces your required annual income by $12,000-$24,000, significantly lowering your target amount.

Generate Side Income

Develop passive income streams (rental properties, dividends, side business) that continue into retirement, reducing your reliance on savings.

5-Year Action Plan

Increase 401k contribution to maximize employer match

Open Roth IRA and set up automatic monthly contributions

Pay down high-interest debt and increase emergency fund

Optimize investment allocation and consider real estate

Review progress and adjust strategy based on results

About the Author

Jurica Šinko

Finance Expert, CPA, MBA

Jurica has over 15 years of experience in corporate finance, investment management, and retirement planning. He holds an MBA in Finance and is a Certified Public Accountant (CPA) with expertise in helping individuals and families plan for secure retirements.

Passionate about making financial planning tools accessible to everyone, Jurica founded EFinanceCalculator to provide accurate, easy-to-use calculators that help people make informed decisions about their financial future.

Key Takeaways

Remember These Critical Points:

- ✓Start early - every decade of delay adds 5-8 years to retirement age

- ✓Compound interest provides 60-80% of your final retirement balance

- ✓Small increases in savings rate dramatically improve retirement timeline

- ✓Healthcare costs can increase your needed savings by 25-30%

Next Steps:

- 1Use our calculator above to determine your current retirement age

- 2Identify 2-3 strategies to optimize your timeline

- 3Implement changes gradually and track progress annually

- 4Adjust your plan as life circumstances change