Understanding Your Social Security Benefits in 2025

For most Americans, Social Security is the bedrock of retirement planning. In 2025, maximizing this guaranteed, inflation-protected income stream is more critical than ever. Whether you are approaching age 62 or planning decades ahead, understanding the mechanics of your benefit calculation can add tens of thousands of dollars to your lifetime wealth.

This guide breaks down the complex "Primary Insurance Amount" (PIA) formula, explains how the 2025 bend points affect high earners vs. low earners, and demonstrates why the decision of when to claim is often the most significant financial choice you will make in retirement.

The 3-Step Benefit Formula

Calculate AIME

Apply Bend Points

Adjust for Age

Why Waiting Pays Off (Literally)

The 8% Guarantee

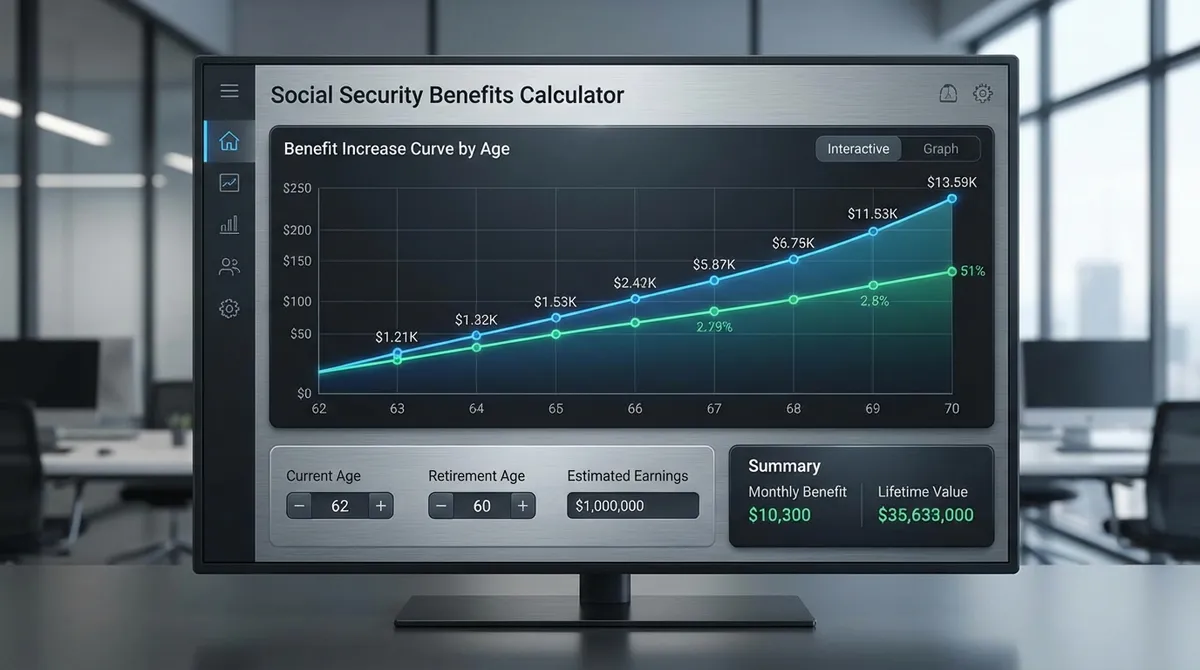

There are very few guaranteed returns in finance. Social Security is one of them. For every year you delay claiming past your full retirement age (up to age 70), your benefit increases by 8%. Compare this to the investment returns you might expect elsewhere.

*Example based on a $2,000 PIA. That is a 77% increase in monthly income for the rest of your life, which also boosts the survivor benefit for your spouse.

3 Expensive Mistakes to Avoid

Don't fixate on "how long until I break even?" Actuarially, if you live past 80, waiting usually wins. But more importantly, waiting provides longevity insurance—a higher check when you are 95 and have drained other assets like your 401(k) balance.

If you claim early (62-66) and keep working, $1 is withheld for every $2 you earn above $23,400 (2025 limit). While you get this back later, it defeats the purpose of early "cash flow."

You may be entitled to 50% of your spouse's benefit if it's higher than your own. Divorced? You can still claim on an ex-spouse's record if married 10+ years.

Special Situations: Disability & Divorce

Disability (SSDI)

Social Security isn't just for retirees. If you become disabled before retirement age, you may qualify for Social Security Disability Insurance (SSDI).

Key Rules:

- You must have worked recently (usually 5 of the last 10 years).

- The disability must be expected to last at least one year or result in death.

- Your benefit amount is generally equal to your full PIA, regardless of your age.

Divorce Benefits

If your marriage ended, you might still legally own a piece of your ex-spouse's Social Security record.

To Qualify:

- Marriage lasted at least 10 years.

- You are essentially unmarried (if you remarried, you lose this right unless that marriage also ended).

- You are age 62 or older.

- Your ex-spouse is entitled to Social Security (even if they haven't claimed yet, as long as you've been divorced 2+ years).

The "Stealth Tax": Improving Your After-Tax Benefit

Many retirees are shocked to learn their Social Security check is not tax-free. Depending on your "Combined Income" (AGI + Nontaxable Interest + 50% of your Benefit), a portion of your benefit becomes taxable income. Understanding your tax bracket is essential here.

| Filing Status | Combined Income | Taxable Portion |

|---|---|---|

| Single | $25,000 - $34,000 | Up to 50% |

| Single | Over $34,000 | Up to 85% |

| Married Jointly | $32,000 - $44,000 | Up to 50% |

| Married Jointly | Over $44,000 | Up to 85% |

*Note: These thresholds are not adjusted for inflation, meaning more retirees get hit with this tax every year.

Maximizing Household Income: Strategies for Couples

If you are married, you shouldn't view your Social Security claiming decisions in isolation. You have two lives, two earnings records, and three potential benefits (Worker A, Worker B, and Survivor). Coordinating your claims can add over $100,000 to your lifetime household income.

The "Split" Strategy

This is the most common optimal strategy for couples with different earnings records.

- Lower Earner: Claims early (e.g., 62 or 63) to generate immediate cash flow.

- Higher Earner: Delays until age 70 to maximize the "Survivor Benefit" bucket.

Why it works: You get some income now, but you strictly protect the payout of the surviving spouse (who will eventually live on the higher of the two checks).

The "Bridge" Strategy

If you have other retirement savings (401k, IRA), you can use them to "buy" a higher Social Security check.

- Both spouses delay Social Security.

- You live off your 401k/IRA withdrawals from age 62 to 70.

- At 70, you switch to your maximized Social Security checks.

Why it works: You are effectively getting a guaranteed 8% return on the money you spent from your IRA to enable the delay—a return you can't guarantee in the stock market.

Don't Forget the "Restricted Application" (For Older Couples)

If you were born before January 2, 1954, you might still legally use the "Restricted Application" loophole. This allows you to claim only spousal benefits at Full Retirement Age while letting your own worker benefit continue to grow until 70. For everyone born after that date, this loophole is closed (thanks to the Bipartisan Budget Act of 2015).

The "2034 Problem": Will Social Security Be There?

You have likely heard the headlines: "Social Security is going bankrupt." This is misleading. Here is the reality based on the latest Trustees Report:

- The Trust Fund: The excess cash reserves (OASI Trust Fund) are projected to be depleted around 2033–2034.

- The Consequence: If Congress does nothing, the system generally reverts to a "pay-as-you-go" model. Incoming payroll taxes would cover approximately 79% of scheduled benefits.

- The Result: This would mean an automatic 21% cut across the board for all beneficiaries—NOT a total stopping of checks.

Planning Tip: Conservative planners often model a 20-25% reduction in their long-term projections for beneficiaries under age 55, just to be safe. However, historically, Congress has always stepped in to patch the system (raising retirement age, increasing payroll taxes) before cuts occur.

Frequently Asked Questions

If I die, does my family keep getting benefits?

Yes, through Survivor Benefits. A widow or widower can receive up to 100% of your benefit. Additionally, unmarried children under 18 (or 19 if in high school) can receive benefit checks worth 75% of your amount, subject to a family maximum.

Can I collect Social Security and a Pension? (WEP/GPO)

If your pension is from a job where you did not pay Social Security taxes (like some government jobs), your Social Security benefit may be reduced by the Windfall Elimination Provision (WEP). Similarly, spousal or survivor benefits might be reduced by the Government Pension Offset (GPO). This mainly affects teachers, police officers, and federal employees under the old CSRS system.

How do I verify my earnings record?

You should check your earnings record annually. Create a free account at ssa.gov/myaccount. If you spot an error—like a year of missing earnings—you must provide W-2s or tax returns to prove the income, or that year will remain a "zero" in your average.

What is the maximum Social Security benefit in 2025?

The maximum benefit depends on the age you retire. For someone retiring at full retirement age in 2025, the maximum monthly benefit is roughly $4,018. However, if you wait until age 70 to claim, that maximum can jump to over $5,100 per month. Achieving this maximum requires earning the taxable maximum (the "wage base") for at least 35 years of your career.

Will my benefits increase with inflation?

Yes, Social Security benefits are one of the few retirement income sources adjusted annually for inflation through the Cost-of-Living Adjustment (COLA). This adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). For 2025, the COLA was set to reflect rising prices, ensuring your purchasing power remains relatively stable throughout retirement.

Can I work and collect Social Security at the same time?

Yes, but if you are under your Full Retirement Age (FRA), you are subject to the Earnings Test. If you earn above the annual limit ($23,400 in 2025), $1 is withheld for every $2 you earn above that limit. Once you reach FRA, this limit disappears, and you can earn unlimited income without any reduction in your benefits. Plus, the withheld amount is recalculated and added back to your benefit after you reach FRA.

How does divorce affect my Social Security benefits?

If you were married for at least 10 years and are currently unmarried, you may be eligible to claim benefits on your ex-spouse's record. This does not affect your ex-spouse's benefit amount or the benefits of their current spouse if they have remarried. You must be at least 62 years old, and your ex-spouse must be entitled to Social Security retirement or disability benefits.

Maximizing Your Lifetime Benefits

Beyond the basic claiming strategies, there are nuanced ways to ensure you are getting every dollar you deserve. Social Security is complex, and small oversights can lead to permanent reductions in income.

Review Your Earnings Record

Your benefit is calculated based heavily on your highest 35 years of indexed earnings. If the SSA has incorrect data (e.g., they missed a year of high earnings), your benefit will be permanently lower.

- Log in to ssa.gov annually.

- Verify every year of earnings against your own records (W-2s, tax returns).

- Submit a "Request for Correction of Earnings Record" (Form SSA-7008) immediately if you find discrepancies.

Minimize Taxation of Benefits

Keeping your "Combined Income" low can save you thousands in taxes. Withdrawals from Roth IRAs are not included in this calculation, whereas Traditional IRA withdrawals are.

- Consider Roth conversions in your early 60s before claiming benefits.

- Manage capital gains distributions carefully in retirement.

- Use a "tax-efficient withdrawal strategy" to stay under taxation thresholds where possible.

The "Do-Over" Clause

Did you claim early at 62 and now regret it? You have a one-time "do-over" option. If you change your mind within 12 months of claiming, you can withdraw your application, repay the benefits you've received (interest-free), and reset your claiming clock as if you never filed. This allows your benefit to continue growing until you re-apply later.

About Jurica Šinko

Jurica Šinko is a finance expert and the founder of EFinanceCalculator. With 15+ years in investment management, he specializes in simplifying complex retirement tax laws for everyday planners.