Comprehensive Guide to 2025 State Income Taxes

While federal income taxes grab the headlines, state income taxes often have a more direct impact on your day-to-day purchasing power. In 2025, the gap between "high-tax" and "low-tax" states has widened, making your location one of the most significant factors in your financial plan.

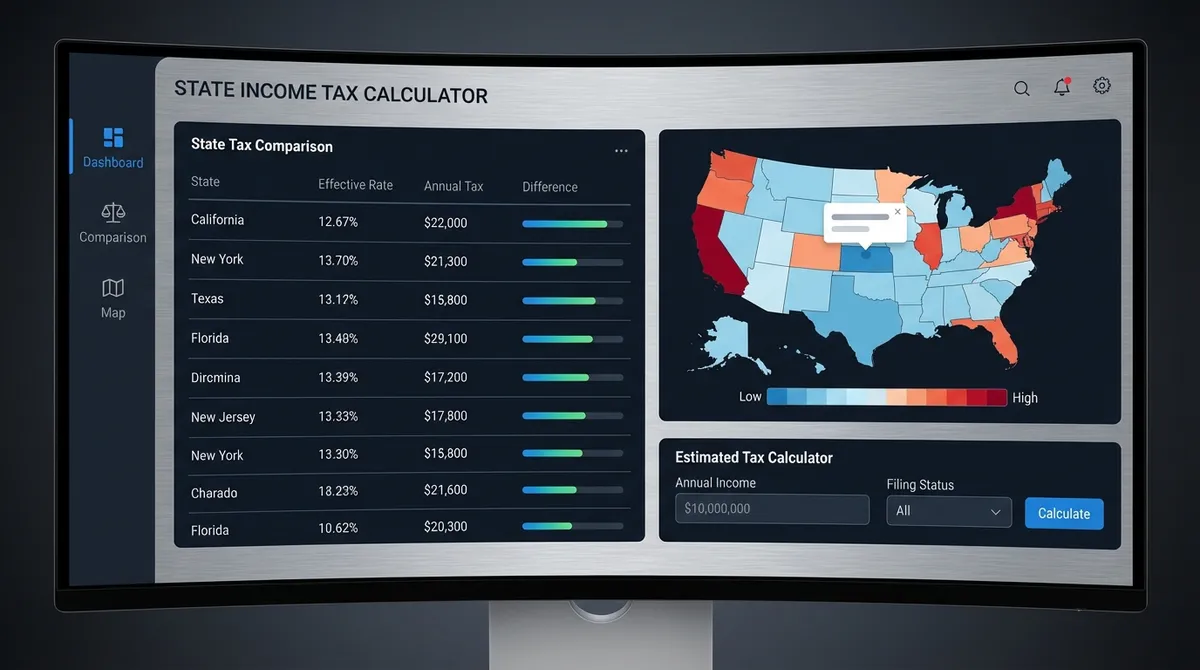

From California's top marginal rate of 14.4% (including mental health surtaxes) to the nine states with zero income tax (see our map at Tax Foundation), the difference for a high earner can exceed $50,000 annually. This guide breaks down how state taxes work, where the burdens are heaviest, and how to verify your estimated liability before tax season arrives.

Key Update for 2025: Inflation adjustments have shifted brackets in many progressive states like California and New York, potentially lowering your effective rate if your income hasn't kept pace with inflation. Meanwhile, states like North Carolina and Iowa are aggressively cutting rates to attract remote workers.

Reviewing the Three State Tax Systems

1. Flat Tax

One rate for everyone. As of 2025, more states are moving this way to simplify codes.

2. Progressive Tax

"Pay more as you earn more." Rates climb through bracket tiers, similar to federal tax brackets.

3. Zero Tax

No tax on earned wages. Often funded by higher property or sales taxes.

How Your State Tax Bill is Calculated

Calculating state tax isn't as simple as applying a percentage to your gross pay. Deductions play a massive role. Here is the standard formula used by most Departments of Revenue:

Federal AGI

Most states start with your Federal Adjusted Gross Income.

State Modifications

Subtract state-exempt income (like Social Security or U.S. Bond interest). Add non-qualified income.

Deductions

Apply the Standard Deduction (varies by state) or itemize if allowed.

Tax Calculation

Apply the tax rate schedule to the Taxable Income (which determines your net income).

Case Study: The $100,000 Salary Comparison

Does moving really save you money? Let's look at the numbers for a single filer earning $100,000 in three different environments.

Strategic Planning for Remote Workers

The rise of remote work has made state tax arbitrage a real financial strategy.

The "183-Day Rule"

Most states consider you a resident for tax purposes if you spend more than 183 days (roughly 6 months) there. If you split time between states, track your location carefully.

Telecommuting Laws ("Convenience of the Employer")

Warning: States like New York have "convenience rules." If you work remotely for a NY company but live in CT, NY may still tax your income unless the work *must* be done elsewhere for necessity, not choice.

How to Lower Your State Tax Bill

While you can't easily change your location overnight, you can use these strategies to reduce your "Adjusted Gross Income" (AGI) on the state level.

Contribute to Retirement Accounts

Most states use your Federal AGI as a starting point. Contributing to a traditional 401(k) or 403(b) reduces your federal income, which automatically reduces your state taxable income in most jurisdictions.

529 College Savings Plans

Over 30 states offer a specific tax deduction or credit for contributing to their specific 529 plan. For example, New York allows a deduction of up to $10,000 for married couples filing jointly.

Municipal Bonds ("Munis")

Interest earned on municipal bonds issued by your own state is typically triple-tax-free: exempt from federal, state, and often local taxes. This is a powerful tool for high earners in states like CA and NY.

HSA Contributions

Like 401(k)s, Health Savings Account (HSA) contributions reduce your federal AGI, which flows down to lower your state tax bill (except in CA and NJ, which do not conform to federal HSA rules).

Emerging Trends in State Taxation (2025 & Beyond)

State tax codes are not static. As we move deeper into the 2020s, several key trends are reshaping how states generate revenue. Understanding these shifts can help you anticipate future tax liabilities and potential savings opportunities.

The Shift from Income to Consumption Tax

Many states are gradually reducing income tax rates while expanding their sales tax bases. This shift aims to incentivize work and investment while capturing revenue from consumption. For example, states like Kentucky and North Carolina have explicitly set goals to phase out their income taxes entirely over time, replacing the lost revenue with broader sales taxes on services and digital goods.

The "Millionaire's Tax" Movement

Conversely, states facing budget deficits (like Massachusetts with its "Fair Share Amendment" and California) are introducing targeted surtaxes on high-income earners. These often kick in at income levels above $1 million, $5 million, or even lower thresholds in some jurisdictions. These taxes are frequently earmarked for specific public services like education or transit.

- Massachusetts: A 4% surtax on income over $1 million.

- California: A 1% mental health surcharge on income over $1 million, with potential future limits on tax credits for high earners.

- Washington: A capital gains tax on high-profit asset sales, despite having no income tax.

PTE Taxes (Pass-Through Entity Tax)

This is a critical workaround for business owners stuck with the $10,000 SALT (State and Local Tax) cap on their federal return. Over 30 states now allow business owners (LLCs, S-Corps) to pay state income tax at the entity level rather than the personal level.

Why it matters: By paying tax at the company level, the business deducts the tax as a business expense, effectively bypassing the $10,000 federal limit. This can save business owners thousands in federal taxes.

State Income Tax vs. Overall Cost of Living

It is a common mistake to choose a place to live based solely on its income tax rate. While states like Texas and Florida boast "0% Income Tax," they often make up for this revenue shortfall through other channels that can affect your wallet just as heavily.

The "Zero Tax" Trade-Off

Property Taxes: Texas has some of the highest property tax rates in the nation (often exceeding 1.8% of home value), which can act as a "wealth tax" on your home equity.

Sales Taxes: Tennessee has no income tax on wages but imposes a state sales tax of 7%, with local additions pushing the total near 10% on almost every purchase you make.

The "High Tax" Benefit

Services & Safety Nets: High-tax states like Massachusetts and Minnesota often rank highest in public school quality, healthcare access, and social safety nets.

Higher Wages: These states often command higher average salaries. A 5% tax on a $150,000 salary usually leaves you with more take-home pay than a 0% tax on a $100,000 salary for the exact same role.

Frequently Asked Questions

Do I have to file a state return if I moved halfway through the year?

Yes, you will likely need to file part-year resident returns in both states. You will allocate your income based on when it was earned or simply split the year's total income based on days lived in each state. It adds paperwork but ensures you aren't double-taxed.

What happens if I live in one state but work in another?

You typically pay taxes to the state where you work/earn the money first. Then, you file a return in your home state and claim a "credit for taxes paid to another state" to avoid paying twice on the same dollar. If the two states have a reciprocity agreement (like PA and NJ), you only pay tax to your home state.

Are social security benefits taxed by states?

It depends. 38 states (plus DC) do not tax Social Security benefits. However, 12 states (including CO, CT, KS, MN, MT, NM, RI, UT, VT, and WV) may still tax a portion of benefits, though many have income exemptions for lower earners.

Which states have the highest income tax rates?

California tops the list with a 13.3% rate for millionaires (plus surcharges totaling 14.4%). Hawaii (11%), New York (10.9%), New Jersey (10.75%), and Oregon (9.9%) follow closely behind.