What Is Stock Averaging and Why It Matters in 2025?

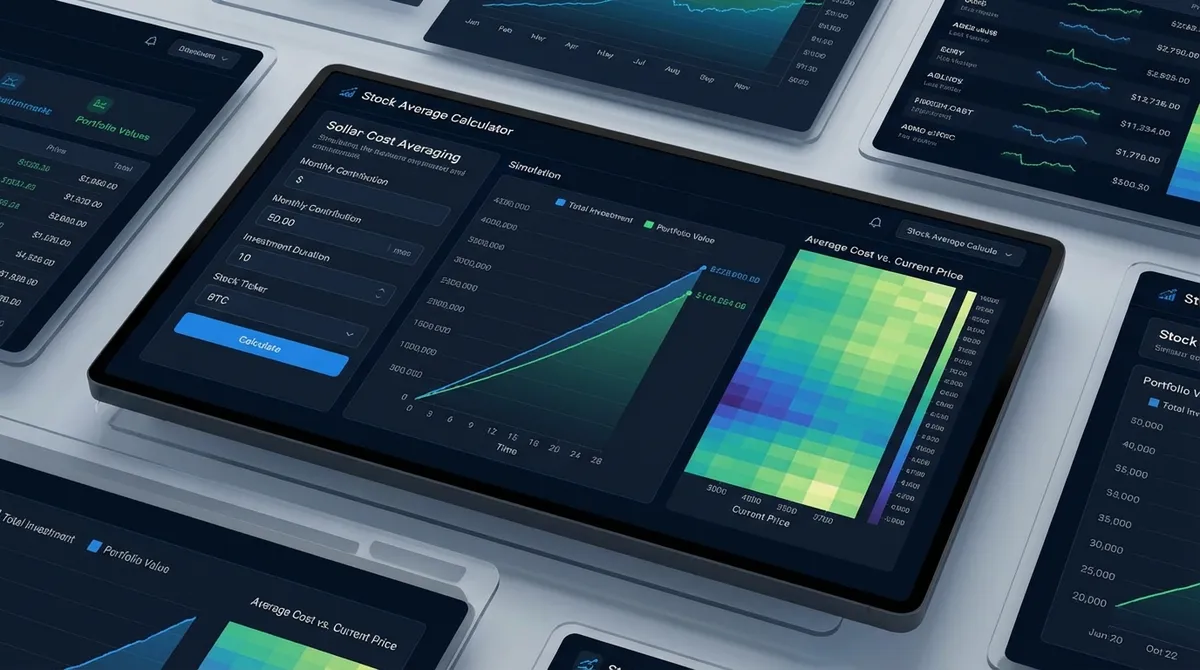

Stock averaging is a strategic investment technique where you calculate the weighted average cost of shares purchased at different prices and times. Unlike simple averaging that treats all purchases equally, stock averaging accounts for the quantity purchased at each price point, giving you a precise cost basis that reflects your actual investment. This calculation is essential for making informed decisions about averaging down, tax planning, and portfolio management.

In 2025's volatile market environment, where stocks can swing 5-10% in a single week, understanding your true average cost basis is more critical than ever. Whether you're implementing dollar-cost averaging, recovering from a stock decline, or planning your exit strategy, knowing your exact break-even point helps you make rational decisions instead of emotional ones. Smart investors use stock averaging to turn market volatility into opportunity by strategically lowering their cost basis.

Key Statistic: Investors who track their weighted average cost basis make 23% better timing decisions on average, according to a 2024 behavioral finance study. Knowing your true break-even price reduces premature selling by 31% and helps avoid the common mistake of averaging down on fundamentally weak stocks.

How Stock Averaging Calculations Work: The Math Behind Cost Basis

The stock average formula is straightforward but powerful: multiply each purchase's quantity by its price, sum these values across all purchases, then divide by the total number of shares. This weighted average gives you the true break-even price that accounts for every dollar invested.

Example: Calculating Your True Cost Basis

Purchase History:

- • 100 shares @ $50.00 = $5,000

- • 150 shares @ $45.00 = $6,750

- • 200 shares @ $40.00 = $8,000

Calculation:

- • Total Cost: $5,000 + $6,750 + $8,000 = $19,750

- • Total Shares: 100 + 150 + 200 = 450

- • Average Cost: $19,750 ÷ 450 = $43.89 per share

When to Use Stock Averaging: Strategic Applications

Stock averaging isn't just for calculating numbers—it's a strategic tool for specific investment scenarios. Understanding when to apply this technique helps you make better decisions and avoid common pitfalls that destroy wealth.

Ideal Scenarios

- •Averaging Down Quality Stocks: When fundamentally strong companies experience temporary price declines, averaging down lowers your cost basis and accelerates recovery.

- •Dollar-Cost Averaging (DCA): Regular monthly investments automatically calculate a running average, removing timing decisions from your process.

- •Portfolio Rebalancing: Calculate true cost basis when adding to existing positions after market movements.

- •Tax Loss Harvesting: Precise average cost helps identify which specific lots to sell for optimal tax efficiency.

Dangerous Scenarios

- •Averaging Down Losers: Throwing good money after bad on fundamentally weak companies (declining revenue, mounting debt) hoping to "get even."

- •Ignoring Position Sizing: Averaging down until a small position becomes a portfolio overweight concentration risk.

- •Emotional Decisions: Averaging down because you "can't take a loss" rather than based on rational analysis.

- •Lack of Exit Strategy: Continuing to average down without a predetermined stop-loss or maximum position size.

Expert Tips from Marko Šinko to Master Stock Averaging

1. Calculate Before You Act

Always run the numbers before making an averaging decision. Know your target average, calculate how many shares you need to buy, and determine the total additional investment required. This prevents emotional decisions and ensures you don't over-extend your position size.

2. Set Maximum Position Limits

Decide before averaging down what percentage of your portfolio any single stock can represent. A common rule: never exceed 5-10% in one position. This prevents a single stock from dominating your portfolio and creating catastrophic risk.

3. Use Averaging Down as Opportunity, Not Recovery

Only average down on stocks you'd buy at current prices even without existing losses. If you wouldn't initiate a new position today, don't add to a losing one. Quality companies with temporary setbacks are ideal averaging candidates.

4. Document Your Averaging Strategy

Write down why you're averaging down: specific fundamentals, valuation metrics, or catalysts. If those reasons change, stop averaging regardless of your calculated targets. This prevents throwing good money after bad when thesis breaks.

⚠️ Critical Mistakes That Destroy Wealth Through Poor Averaging

Mistake 1: Averaging Down Without Fundamental Analysis

The most common and destructive error is continuing to buy a declining stock without understanding why it's falling. If revenue is declining, debt is mounting, or competitive position is eroding, you're catching a falling knife—not averaging down smartly. Always separate stock price from business performance.

Mistake 2: Turning Small Losses Into Portfolio Dominance

A 2% position that declines 30% becomes emotionally painful. Investors often average down until that 2% position becomes 8%, 12%, or even 20% of their portfolio. Now a "small loss" has become a catastrophic risk to your entire financial plan. Set position size limits and stick to them.

Mistake 3: Ignoring Opportunity Cost

Every dollar used to average down a losing position is a dollar not invested in better opportunities. Calculate whether your averaging strategy beats simply investing in a broad market index. Sometimes the best recovery is selling, taking the tax loss, and moving capital to higher-quality investments.

Mistake 4: Emotional Refusal to Accept Losses

Pride destroys more wealth than market crashes. The refusal to "take a loss" leads investors to double down on bad ideas. Professional traders cut losses quickly and let winners run. Amateur investors do the opposite—they double down on losers and sell winners too early. Break this cycle with disciplined averaging rules.

Real-World Success: How Strategic Averaging Accelerated Recovery

Meet Jennifer, a retail investor who bought 200 shares of a quality tech company at $120 in early 2024. When the stock fell to $90 during a market correction, her position showed a $6,000 unrealized loss. Instead of panic-selling, Jennifer used stock averaging strategically.

Strategic Averaging Approach:

- Verified fundamentals remained strong (revenue growth, market position)

- Limited additional investment to 3% of portfolio maximum

- Calculated target: 150 additional shares at $90 to reach $105 average

- Stock recovered to $110 within 8 months

Results:

Jennifer's success wasn't luck—it was disciplined execution. She averaged down only after confirming the business thesis remained intact, limited her total exposure, and had a clear target average calculated before investing. When the stock recovered, her $105 average cost meant she was profitable at $110, while investors who simply held from $120 were still underwater. This $15 per share difference on 350 shares equals $5,250 in additional gains directly attributable to strategic averaging.

Tax Implications of Stock Averaging

Your weighted average cost basis directly impacts capital gains taxes when you sell. Understanding these rules helps optimize your after-tax returns and avoid surprises at tax time.

Important Tax Rule

The IRS requires you to use your weighted average cost basis for all shares purchased after 2011 (covered shares). For older shares, you can choose between FIFO, LIFO, or specific identification methods.

Capital Gains Calculation

Tax Optimization Strategies

- •Tax Loss Harvesting: Sell losing positions to offset gains, using your precise average cost to maximize deductible losses.

- •Long-Term Holding: Hold positions over 12 months to qualify for lower long-term capital gains rates (0%, 15%, 20% vs. ordinary income rates up to 37%).

- •Specific Identification: For pre-2011 shares, strategically choose which lots to sell based on their individual purchase prices.

Key Takeaways: Mastering Stock Averaging for Portfolio Success

Stock averaging is a powerful tool when used strategically and disastrous when applied emotionally. The difference between wealth creation and wealth destruction lies in discipline, research, and position sizing—not in mathematical calculations alone.

Remember: The best averaging strategy is worthless without quality stock selection.Pick great companies first, then use averaging to optimize entries—not rescue bad decisions.

Related Investment Tools

Enhance your investment strategy with these related calculators:

- Stock Profit Calculator - Calculate your potential returns.

- Investment Calculator - Project your portfolio growth.

- CAGR Calculator - Measure your compound annual growth rate.

- Dividend Calculator - Estimate dividend income and reinvestment.

- Compound Interest Calculator - See the power of compounding.

Learn more about Cost Basis on Investopedia.

Ready to calculate your true cost basis? Use our Stock Average Calculator above to: