Maximizing Your Refund with Tax Credits in 2025

In the world of taxes, credits are king. Unlike tax deductions, which only lower the income you're taxed on, tax credits reduce your tax bill dollar-for-dollar. A $2,000 deduction might save you $440 if you're in the 22% bracket, but a $2,000 tax credit saves you exactly $2,000—guaranteed.

For the 2025 tax year, several key credits have been adjusted for inflation, offering even more relief for families, students, and homeowners. Whether you're looking to claim the boosted Earned Income Tax Credit (EITC), the Child Tax Credit, or clean energy incentives, understanding the specific rules is crucial to leaving no money on the table.

Refundable vs. Non-Refundable: The Critical Difference

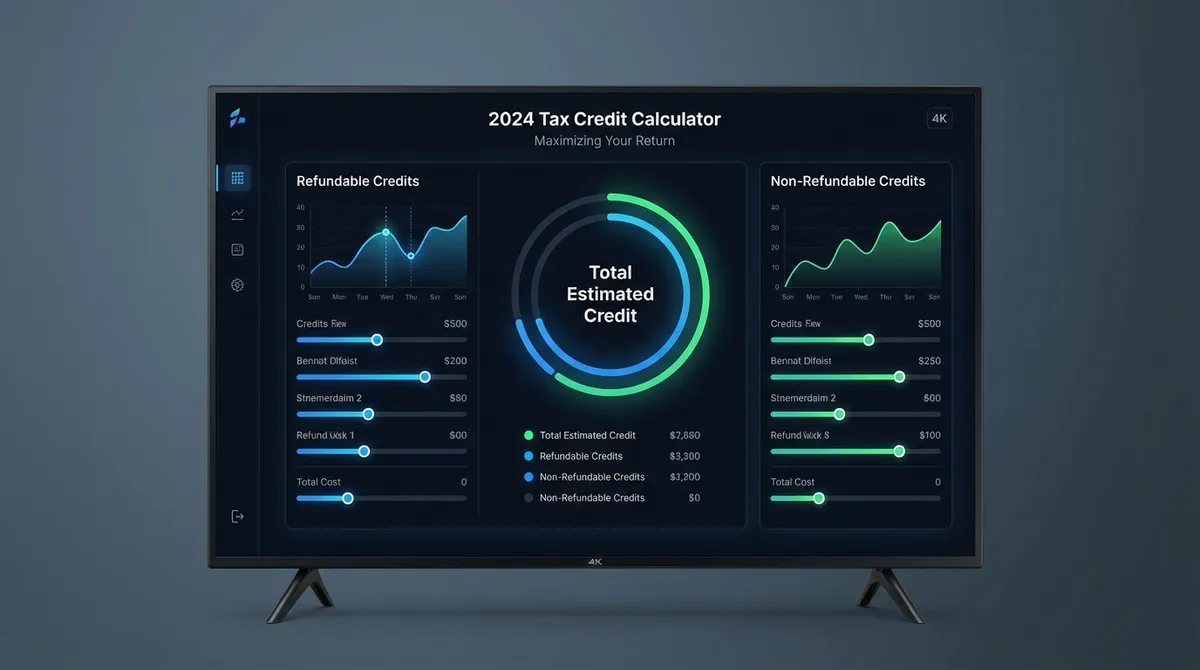

Refundable Credits are the holy grail of tax planning. If these credits drop your tax bill to zero, the IRS sends you a check for the remaining amount (e.g., EITC). Non-Refundable Credits can reduce your taxes to zero, but you won't get the excess back in cash (e.g., Solar Credit). Our calculator automatically separates these for you to give a clear picture of your potential refund.

Top Tax Credits Available for 2025

Earned Income Tax Credit (EITC)

Designed for low-to-moderate income workers, the EITC is one of the most generous credits. For 2025, the maximum credit has risen to significantly help families cope with inflation.

- Max Value: ~$7,830 (3+ children)

- Investment Income Limit: $11,600

- Phase-Out: Begins around $29k-$70k depending on status

Child Tax Credit (CTC)

Parents can claim up to $2,000 for each qualifying child under 17. Of this, up to approximately $1,700 is refundable (known as the Additional Child Tax Credit) if you owe no tax.

Education Credits (AOTC & LLC)

American Opportunity Tax Credit (AOTC): Best for undergrads. Worth up to $2,500 per student/year. 40% is refundable (up to $1,000).

Lifetime Learning Credit (LLC): For grad students or job training. Worth up to $2,000 per return. Non-refundable.

Residential Clean Energy

Under the Inflation Reduction Act, you can claim 30% of the cost of installing solar panels, wind turbines, or battery storage. There is no dollar limit on this credit for solar. Unused credits can carry forward to future years.

Strategies to Maximize Your Credits

- Watch Your AGI for Phase-Outs

Credits like the CTC and AOTC disappear once your income hits certain levels ($80k/$160k for AOTC). Contributing more to a traditional 401(k) or HSA reduces your AGI, potentially "unlocking" these credits again.

- Don't Double Dip Education Expenses

You cannot use the same tuition expenses for both a tax-free 529 distribution and the AOTC. Usually, it's better to pay the first $4,000 of tuition out-of-pocket (to claim the $2,500 AOTC) and use 529 funds for housing or books.

- Time Your Home Upgrades

The Energy Efficient Home Improvement Credit has a general annual cap of $1,200 (with exceptions for heat pumps). If you plan to replace windows and doors, spreading the project over two calendar years lets you claim the max credit twice.

Deep Dive: How Refundable Credits Work

Refundable tax credits are arguably the most powerful tool in the U.S. tax code for building wealth. Unlike deductions that simply reduce the income you are taxed on, refundable credits can result in a negative tax rate—meaning the government pays you.

The "Additional" Child Tax Credit (ACTC)

While the Child Tax Credit is $2,000, only a portion of it is refundable (up to ~$1,700 for 2025). This refundable portion is called the ACTC.

- Eligibility: You must have earned income of at least $2,500.

- Calculation: The refund is calculated as 15% of your earned income above $2,500, up to the $1,700 cap per child.

- Impact: This ensures that even low-income working families receive a significant benefit, acting as a wage supplement.

The Premium Tax Credit (PTC)

If you buy health insurance through the Healthcare.gov marketplace, you likely receive this credit in advance to lower your monthly premiums. However, it MUST be reconciled on your tax return.

Warning: If your income increased significantly during the year and you didn't update the marketplace, you may have to pay back some of the PTC you received in advance. This is a common surprise that reduces expected refunds.

How to Claim These Credits (Forms & Schedules)

Taking advantage of these credits requires filing the correct forms with your Form 1040. Missing a form often means missing the credit.

| Credit Name | Required IRS Form | Complexity |

|---|---|---|

| Child Tax Credit | Schedule 8812 | Low |

| Earned Income Credit | Schedule EIC | Medium |

| Child Care Credit | Form 2441 | Medium |

| Education Credits | Form 8863 | Medium |

| Res. Clean Energy | Form 5695 | High |

Common Mistakes to Avoid

- Missing the "Non-Refundable" Trap: Don't panic if your non-refundable credits exceed your tax bill. While you lose the excess for that year (except for solar carryforwards), you still reduced your tax to $0.

- Forgetting State Credits: This calculator focuses on Federal credits. Many states have their own EITC or child credits that stack on top of federal ones.

- Investment Income Limit: If you have over $11,600 in interest, dividends, or capital gains, you are automatically disqualified from the EITC, regardless of how low your wages are.

Frequently Asked Questions

Can I claim tax credits if I take the Standard Deduction?

Yes! This is a huge misconception. Tax credits operate completely independently of your deduction choice. You can claim the Child Tax Credit, EITC, and Education Credits even if you do not itemize.

Do tax credits expire?

Most non-refundable credits operate on a "use it or lose it" basis for the specific tax year. However, certain credits like the Residential Clean Energy Credit (Solar) and the Adoption Credit allow you to "carry forward" unused amounts to future tax years.

What is the income limit for the Child Tax Credit in 2025?

The full $2,000 credit is available for single filers with MAGI under $200,000 and married couples under $400,000. Above these thresholds, the credit reduces by $50 for every $1,000 of income. It vanishes completely at higher income levels.

Does the EV Tax Credit reduce my refund?

Starting in 2024, the EV credit ($7,500) can be transferred to the dealer at the point of sale for an immediate discount. If you choose to claim it on your tax return instead, it is non-refundable, meaning it can reduce your tax to zero but won't generate a check beyond that.

How do I fix a mistake on a credit I claimed?

If you realize you missed a credit after filing, you can file an amended return using Form 1040-X. You have up to 3 years from the original filing deadline to claim forgotten credits.

The Future of Tax Credits: What Changes in 2026?

The current tax landscape is heavily influenced by the Tax Cuts and Jobs Act (TCJA) of 2017, but many of its provisions—including the expanded Child Tax Credit structure—are set to "sunset" (expire) at the end of 2025. Unless Congress acts, we could see significant changes:

- Child Tax Credit:Could revert from $2,000 per child back to $1,000, with lower income phase-out thresholds. This would drastically increase taxes for families.

- Other Dependent Credit:The $500 credit for non-child dependents (like elderly parents) was created by the TCJA and could disappear entirely.

- Green Energy:Conversely, the Inflation Reduction Act credits (Solar, EV) are "permanent" for the next decade, meaning green energy incentives will likely remain the most stable source of tax breaks.

Planning Tip: If you are planning major life events (having kids, buying a home, installing solar), keep a close eye on tax legislation in late 2025. The "sunset" cliff could change the ROI of these decisions overnight.