What Are Tax Deductions and Why They Matter in 2025?

Tax deductions are powerful tools that reduce your taxable income, potentially saving you thousands of dollars on your annual tax bill. When you claim a deduction, you subtract the amount from your total income before calculating how much tax you owe. This means every dollar in deductions can save you 10 to 37 cents in taxes, depending on your tax bracket.

For the 2025 tax year (returns filed in 2026), tax deductions continue to be adjusted for inflation. Based on IRS projections, standard deductions have increased. Single filers can claim $15,000, married couples filing jointly get $30,000, and heads of household receive $22,500. These amounts increase even further if you're 65 or older, blind, or both.

Key Insight: According to IRS data, approximately 90% of taxpayers now take the standard deduction rather than itemizing. However, the 10% who itemize often save significantly more—especially homeowners with substantial mortgage interest, high-income earners with state and local tax deductions, and those with major medical expenses. The key is knowing which strategy works best for your specific situation.

Standard vs Itemized Deductions: Making the Right Choice

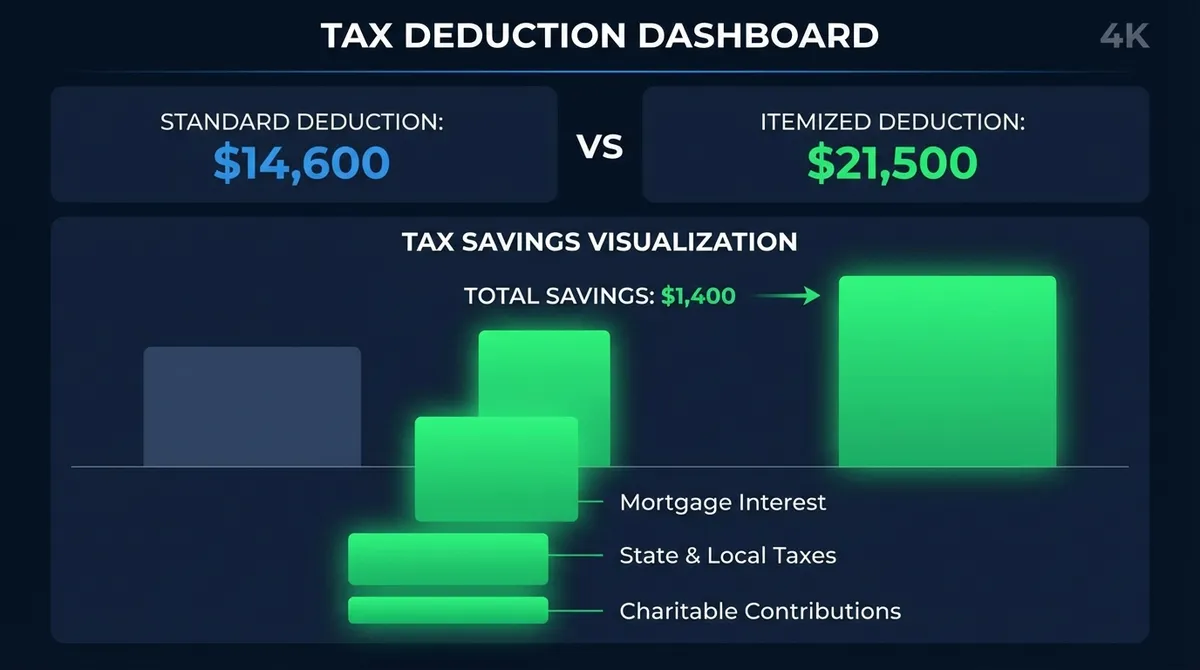

The fundamental choice every taxpayer faces is whether to take the standard deduction or itemize their deductions. You must choose one or the other—you cannot do both. This decision can mean the difference between a refund and owing money, making it one of the most important tax decisions you'll make each year.

Standard Deduction

- Fixed amount based on filing status

- No documentation required

- Simple and fast to claim

- No audit risk from deductions

Itemized Deductions

- Variable based on actual expenses

- Requires detailed records

- More time-consuming to prepare

- Can result in larger deductions

Decision Rule:

Add up all your itemizable deductions. If this total exceeds your standard deduction amount, itemizing will save you money. If it's less than your standard deduction, take the standard deduction for maximum tax savings.

Understanding Major Itemized Deduction Categories

When itemizing deductions, you can claim specific expenses across several categories. Understanding these categories and their limits helps you maximize your tax savings while staying compliant with IRS rules.

Medical and Dental Expenses

You can deduct medical expenses that exceed 7.5% of your Adjusted Gross Income (AGI). For example, if your AGI is $75,000, you can only deduct medical expenses above $5,625. This includes doctor visits, prescriptions, hospital stays, medical devices, and even travel for medical care.

Example: With a $75,000 AGI and $8,000 in medical expenses, only $2,375 is deductible ($8,000 - $5,625). High medical expenses relative to your income make itemizing more attractive.

State and Local Taxes (SALT)

The SALT deduction includes state income taxes or sales taxes, local property taxes, and other state and local taxes. However, since 2018, the SALT deduction has been capped at $10,000 per household ($5,000 if married filing separately). This cap significantly limits the benefit for high-income earners in high-tax states.

Important: You must choose between deducting state income taxes or sales taxes—not both. For most taxpayers in states with income tax, the income tax deduction is larger.

Mortgage Interest

Interest paid on your primary residence and one second home is generally deductible. For mortgages taken out after December 15, 2017, you can deduct interest on up to $750,000 of mortgage debt ($375,000 if married filing separately). Older mortgages may qualify for the previous $1 million limit.

This deduction often makes itemizing worthwhile for homeowners, especially in the early years of a mortgage when interest payments are highest. It's a key factor in the rent vs. buy decision for many households.

Charitable Contributions

Cash donations to qualified charitable organizations are deductible up to 60% of your AGI. Donations of property, stocks, or other assets have different limits. You must have proper documentation for all charitable deductions—cancelled checks, bank statements, or acknowledgments from the charity.

The CARES Act temporarily allowed above-the-line deductions for charitable giving (up to $300 for individuals, $600 for married couples) even when taking the standard deduction, but this provision has expired for 2025 tax returns.

How to Use the Tax Deduction Calculator Effectively

Our Tax Deduction Calculator simplifies the complex decision of whether to take the standard deduction or itemize. Here's how to use it step by step:

Select Your Filing Status

Choose from single, married filing jointly, married filing separately, or head of household. This determines your base standard deduction amount.

Enter Personal Information

Provide your age and indicate if you're legally blind. If you're 65 or older, you qualify for additional standard deductions that can significantly increase your deduction amount.

Enter Your Itemizable Expenses

Input your medical expenses, state and local taxes (SALT), mortgage interest, charitable donations, and other itemizable deductions. The calculator automatically applies IRS rules like the 7.5% AGI floor for medical expenses and the $10,000 SALT cap.

Review Your Results

The calculator shows your standard deduction amount, total itemized deductions, and recommends which strategy saves you more money. It also provides a detailed breakdown of your itemized deductions and shows the exact dollar difference between the two approaches.

Pro Tip:

Run multiple scenarios by adjusting your expenses to see how different financial decisions (like increasing charitable giving or timing medical procedures) might affect your tax strategy.

Real-World Scenarios: Who Benefits Most from Itemizing?

Let's explore three typical scenarios to see how different taxpayers make the standard vs. itemized decision:

Scenario 1: Young Professional (Take Standard Deduction)

Sarah, 28, Single Renter

AGI: $65,000

Lives in a rented apartment, has minimal medical expenses, takes the standard deduction.

Itemized Deductions Breakdown:

- • State Income Tax: $3,250

- • Charitable Donations: $500

- • Medical Expenses: $0 (below 7.5% threshold)

- Total Itemized: $3,750

Smart Choice: Standard Deduction

Standard Deduction: $15,000

Itemized Deductions: $3,750

Tax Savings with Standard: $11,250 more

Sarah saves over $2,800 in federal taxes by taking the standard deduction instead of itemizing.

Scenario 2: Homeowners with Mortgage (Itemize Deductions)

Marcus and Jennifer, Married Filing Jointly, 40s

AGI: $150,000

Own a home in California with a $600,000 mortgage, high state taxes.

Itemized Deductions Breakdown:

- • State Income Tax: $8,500 (SALT cap applies)

- • Property Tax: $8,000 (SALT cap applies)

- • Mortgage Interest: $18,000

- • Charitable Donations: $3,000

- Total Itemized: $37,500

Smart Choice: Itemize Deductions

Standard Deduction: $30,000

Itemized Deductions: $37,500

Tax Savings with Itemizing: $7,500 more

By itemizing, this couple saves an additional $1,800 in federal taxes (24% of $7,500).

Scenario 3: Senior with High Medical Costs

Robert, 68, Head of Household

AGI: $50,000

Has significant medical expenses and is 65+ (gets additional deduction).

Itemized Deductions Breakdown:

- • Medical Expenses: $5,000 (above 7.5% threshold)

- • Property Tax: $3,000

- • State Income Tax: $2,000

- • Charitable Donations: $1,500

- Total Itemized: $11,500

Smart Choice: Itemize Deductions

Standard Deduction (65+): $24,500

Itemized Deductions: $11,500

Tax Savings with Standard: $13,000 more

Even with significant medical costs, Robert's additional age-based deduction makes the standard deduction the better choice. His standard deduction is $24,500 compared to $11,500 in itemized deductions.

Common Tax Deduction Mistakes to Avoid

Mistake #1: Not Keeping Proper Records

If you itemize, you must have documentation for every deduction. Keep receipts, bank statements, and acknowledgment letters from charities for at least three years. The IRS can disallow deductions without proper documentation.

Mistake #2: Misunderstanding the SALT Cap

Many taxpayers are surprised that their state and local tax deduction is limited to $10,000. This includes state income tax, property tax, and sales tax combined. You cannot deduct amounts above this cap.

Mistake #3: Forgetting the Medical Expense Floor

Medical expenses are only deductible above 7.5% of your AGI. If your AGI is $100,000, you need more than $7,500 in medical expenses to claim any deduction at all. Track all qualifying expenses carefully.

Mistake #4: Not Considering Bunching Deductions

If your itemized deductions are close to your standard deduction, consider "bunching"—concentrating two years of charitable giving or medical expenses into one year to exceed the threshold, then taking the standard deduction the next year.

Advanced Tax Deduction Strategies for 2025

Should I prepay my property taxes or mortgage interest to increase deductions?

This strategy, known as "deduction bunching," can work if you're close to the itemizing threshold. Paying your January mortgage payment in December or prepaying estimated property taxes can shift deductions into the current year. However, be aware of the SALT cap for property tax prepayments and the Alternative Minimum Tax (AMT) considerations.

The strategy is most effective if you're slightly below the standard deduction threshold and can time significant expenses to push you over in alternating years. Always consult with a tax professional before implementing bunching strategies.

Can I deduct home office expenses as an employee?

Unfortunately, the Tax Cuts and Jobs Act eliminated the home office deduction for employees through 2025. You can only claim home office deductions if you're self-employed or an independent contractor. If Congress doesn't extend the provision, employees may be able to deduct home office expenses again starting in 2026.

Self-employed individuals can still deduct home office expenses using Form 8829, subject to specific requirements about exclusive and regular use of the space for business purposes.

How do I handle deductions if I'm married filing separately?

When married filing separately, both spouses must use the same deduction method—either both itemize or both take the standard deduction. If one spouse itemizes, the other spouse cannot take the standard deduction, even if it would be more beneficial. This rule prevents couples from splitting deductions strategically.

Additionally, when filing separately, many deduction limits are cut in half: the SALT cap becomes $5,000 instead of $10,000, and phase-out ranges for various deductions are lower. Carefully run the numbers both ways to see if filing jointly or separately saves more money overall.

What if I claimed the wrong deduction method in previous years?

If you discover you would have benefited from itemizing in a previous year, you can file an amended return using Form 1040-X within three years of the original filing date or two years from when you paid the tax, whichever is later. You must amend your federal return if you amend your state return for consistency.

If you itemized when you should have taken the standard deduction, you generally don't need to amend your return—you simply paid more tax than necessary. However, if you discover additional itemized deductions, you might benefit from amending.

Take Control of Your Tax Strategy

The decision between taking the standard deduction or itemizing is more than just a tax question—it's a fundamental part of your financial planning. While most taxpayers benefit from the simplicity of the standard deduction, understanding when itemizing makes sense can save you significant money over time.

Use our Tax Deduction Calculator to model different scenarios, plan major expenses strategically, and make informed decisions about charitable giving, medical procedures, and housing choices. Remember, the best strategy may change from year to year as your income, expenses, and life circumstances evolve.

For complex tax situations or if you're unsure about your deductions, consult with a qualified tax professional who can provide personalized advice based on your specific circumstances and the latest tax law changes.